filmov

tv

How to setup a Loan in QuickBooks

Показать описание

Do you need to set up a Loan in QuickBooks?

The first step to setting up your loan is thinking about exactly what happened…

Did you just get the loan or have you had it for years?

In this video, I'll walk you through these steps to set up your Loan in QuickBooks.

Would you like my step-by-step PDF guide to closing out your books each month?

➡️ Steps to setup a Loan in QuickBooks

Go up to “Lists”

“Chart of Accounts”

Setup your Main Category

Then set up subcategories

Go down to “Account”

Click “New”

Choose “Loan”

Click “Continue”

“Account Name”

**Checkmark “Subaccount of ____________” If it’s a subaccount

“Description”

“Click Enter Opening Balance”

“Enter Opening Balance: Other Current Liability Account” screen will show

**If you have a loan for a long time & you don’t know what the original purchase price

“Opening Balance _____ as of _______ “

“Click “OK”

Click “Save & Close”

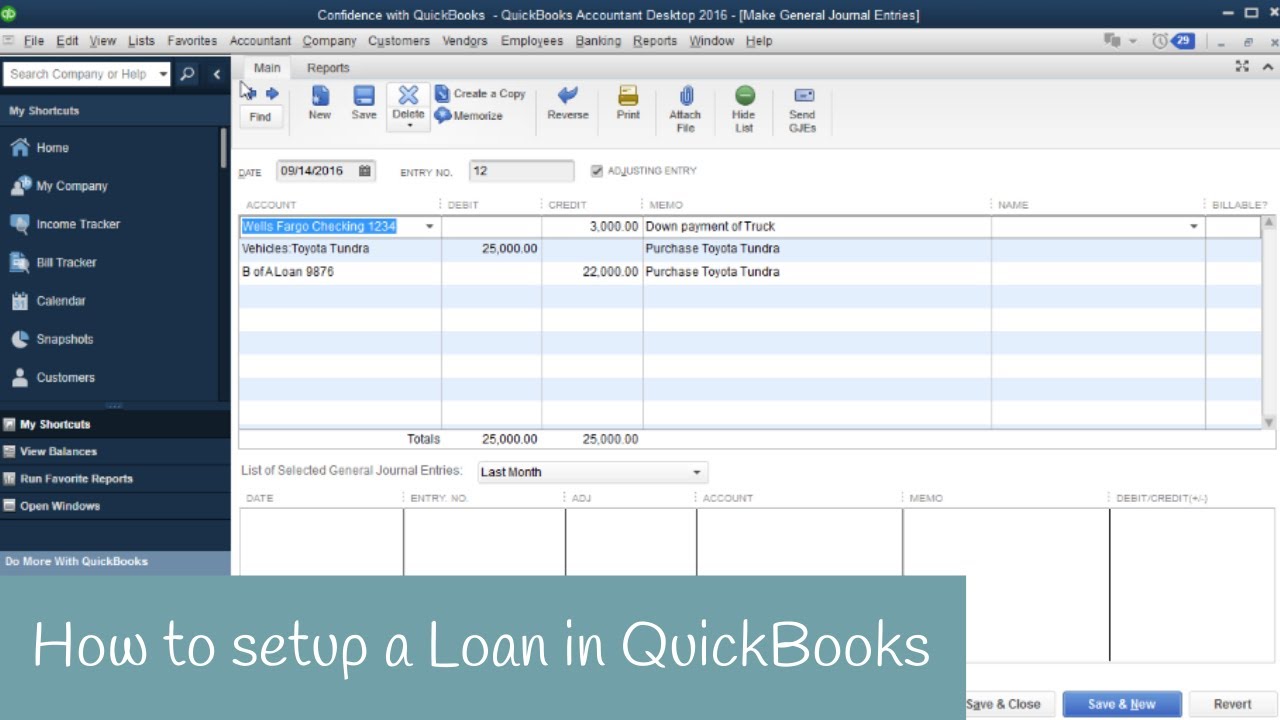

➡️ Recording All Transactions at Once

Go up to “Company”

“Make General Journal Entries…”

“Assigning Numbers to Journal Entries”

Click “OK”

Choose “Account” (1st Line: Bank Account)

“Credit” Amount

“Memo”

“Account” (2nd Line: “Vehicle”)

“Debit” Amount

“Memo”

“Account” (3rd Line: “Loan”)

“Credit” amount

“Memo”

Click “Save & Close”

➡️ Writing Check

Go up to “Banking”

“Write Checks”

“Pay to order of”

“Name not found” screen will show

“Quick Add”

“Select Name Type” screen will show

“Vendor”

“OK”

“Amount”

Under “Expenses” tab, add “Account”

“Amount”

Click “Save & Close”

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe here for more QuickBooks tips

Timestamps:

0:00 - Intro

0:22 - Factors to consider

0:51 - how to enter loan in QuickBooks

3:00 - Record all transactions at once (Journal Entry)

5:31 - Checking Balance Sheet/Bank Account

6:10 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer

The first step to setting up your loan is thinking about exactly what happened…

Did you just get the loan or have you had it for years?

In this video, I'll walk you through these steps to set up your Loan in QuickBooks.

Would you like my step-by-step PDF guide to closing out your books each month?

➡️ Steps to setup a Loan in QuickBooks

Go up to “Lists”

“Chart of Accounts”

Setup your Main Category

Then set up subcategories

Go down to “Account”

Click “New”

Choose “Loan”

Click “Continue”

“Account Name”

**Checkmark “Subaccount of ____________” If it’s a subaccount

“Description”

“Click Enter Opening Balance”

“Enter Opening Balance: Other Current Liability Account” screen will show

**If you have a loan for a long time & you don’t know what the original purchase price

“Opening Balance _____ as of _______ “

“Click “OK”

Click “Save & Close”

➡️ Recording All Transactions at Once

Go up to “Company”

“Make General Journal Entries…”

“Assigning Numbers to Journal Entries”

Click “OK”

Choose “Account” (1st Line: Bank Account)

“Credit” Amount

“Memo”

“Account” (2nd Line: “Vehicle”)

“Debit” Amount

“Memo”

“Account” (3rd Line: “Loan”)

“Credit” amount

“Memo”

Click “Save & Close”

➡️ Writing Check

Go up to “Banking”

“Write Checks”

“Pay to order of”

“Name not found” screen will show

“Quick Add”

“Select Name Type” screen will show

“Vendor”

“OK”

“Amount”

Under “Expenses” tab, add “Account”

“Amount”

Click “Save & Close”

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe here for more QuickBooks tips

Timestamps:

0:00 - Intro

0:22 - Factors to consider

0:51 - how to enter loan in QuickBooks

3:00 - Record all transactions at once (Journal Entry)

5:31 - Checking Balance Sheet/Bank Account

6:10 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer

Комментарии

0:07:31

0:07:31

0:06:39

0:06:39

0:04:05

0:04:05

0:05:47

0:05:47

0:09:29

0:09:29

0:00:59

0:00:59

0:04:51

0:04:51

0:03:10

0:03:10

0:06:05

0:06:05

0:10:41

0:10:41

0:06:54

0:06:54

0:13:43

0:13:43

0:09:12

0:09:12

0:15:48

0:15:48

0:00:40

0:00:40

0:01:00

0:01:00

0:06:34

0:06:34

0:00:59

0:00:59

0:14:07

0:14:07

0:00:35

0:00:35

0:11:58

0:11:58

0:03:49

0:03:49

0:09:01

0:09:01

0:01:00

0:01:00