filmov

tv

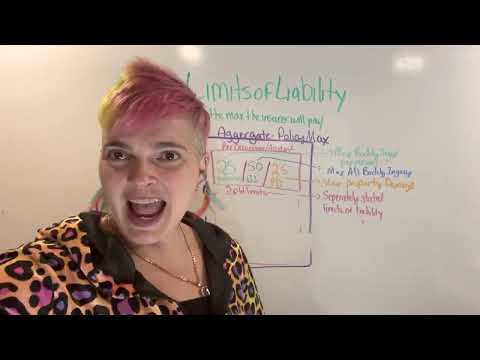

Explain Liability Limits on my Auto Insurance!

Показать описание

Steven Ladd

Horan Companies, Inc

315-635-2095

Question #5 in the 100 insurance questions in 100 day series. By Steve Ladd of Horan Companies, Inc. in Baldwinsville, NY.

See what those large numbers next to the words "bodily injury liability" actually mean on your auto insurance policy.

First, let’s start by realizing that the minimum required amount in the State of New York is $25,000 per person, $50,000 per accident, and $10,000 in property damage.

The $25,000 per person is the minimum amount that you would have available to you in the event that you are sued as a result of an at-fault accident. The $25,000 will cover you for your legal expenses and/or any judgments but only up to that amount.

The second number, the $50,000, is the grand total that anybody can collect in its entirety from any one accident, so not to exceed $25,000 per person but not to exceed $50,000 total in the accident.

If there were three people injured in the other vehicle and all wanted to sue you, then you would have no more than $50,000 total to pay to everybody combined in that accident but not to exceed $25,000 per person.

Oftentimes, you’ll see that the limits on liability are quite a bit higher because no one really wants to go around with $25,000 and expect that it’s going to go very far. Oftentimes, you’ll see limits of $50,000 per person, $100,000 per accident, $100,000 per person, $300,000 per accident, and even higher than that.

The $10,000 portion of the liability coverage in New York is the amount of money that your insurance company would pay to someone else’s property that was damaged in an at-fault accident by yourself.

Think of somebody else’s vehicle being damaged. Your insurance company would pay up to that $10,000 amount, obviously, not very much money, so most people will carry at least $50,000 in property damage but what’s most common is we see $100,000 in property damage coverage. Most times, that will take care of the majority of the mishaps that happen out on the road.

That is what your liability insurance does. It is probably the most important element of any auto insurance policy. Pay strict attention to your limits. Those are the ones there that you want to make sure are up to the point where they will cover everything that you would need it to cover and not have to worry about anybody coming after your own assets, or at least, not as much of them as they otherwise would have.

136 E Genesee St

Baldwinsville, NY 13027

Horan Companies, Inc

315-635-2095

Question #5 in the 100 insurance questions in 100 day series. By Steve Ladd of Horan Companies, Inc. in Baldwinsville, NY.

See what those large numbers next to the words "bodily injury liability" actually mean on your auto insurance policy.

First, let’s start by realizing that the minimum required amount in the State of New York is $25,000 per person, $50,000 per accident, and $10,000 in property damage.

The $25,000 per person is the minimum amount that you would have available to you in the event that you are sued as a result of an at-fault accident. The $25,000 will cover you for your legal expenses and/or any judgments but only up to that amount.

The second number, the $50,000, is the grand total that anybody can collect in its entirety from any one accident, so not to exceed $25,000 per person but not to exceed $50,000 total in the accident.

If there were three people injured in the other vehicle and all wanted to sue you, then you would have no more than $50,000 total to pay to everybody combined in that accident but not to exceed $25,000 per person.

Oftentimes, you’ll see that the limits on liability are quite a bit higher because no one really wants to go around with $25,000 and expect that it’s going to go very far. Oftentimes, you’ll see limits of $50,000 per person, $100,000 per accident, $100,000 per person, $300,000 per accident, and even higher than that.

The $10,000 portion of the liability coverage in New York is the amount of money that your insurance company would pay to someone else’s property that was damaged in an at-fault accident by yourself.

Think of somebody else’s vehicle being damaged. Your insurance company would pay up to that $10,000 amount, obviously, not very much money, so most people will carry at least $50,000 in property damage but what’s most common is we see $100,000 in property damage coverage. Most times, that will take care of the majority of the mishaps that happen out on the road.

That is what your liability insurance does. It is probably the most important element of any auto insurance policy. Pay strict attention to your limits. Those are the ones there that you want to make sure are up to the point where they will cover everything that you would need it to cover and not have to worry about anybody coming after your own assets, or at least, not as much of them as they otherwise would have.

136 E Genesee St

Baldwinsville, NY 13027

0:03:11

0:03:11

0:01:09

0:01:09

0:10:25

0:10:25

0:10:28

0:10:28

0:04:11

0:04:11

0:05:38

0:05:38

0:01:57

0:01:57

0:08:32

0:08:32

0:01:23

0:01:23

0:00:50

0:00:50

0:00:51

0:00:51

0:02:39

0:02:39

0:02:18

0:02:18

0:01:11

0:01:11

0:00:49

0:00:49

0:06:10

0:06:10

0:05:25

0:05:25

0:00:46

0:00:46

0:03:14

0:03:14

0:04:24

0:04:24

0:03:01

0:03:01

0:00:06

0:00:06

0:00:19

0:00:19

0:04:22

0:04:22