filmov

tv

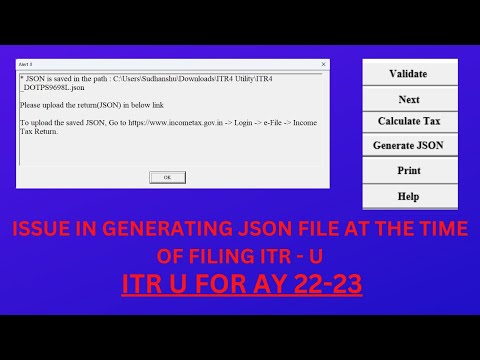

JSON File Income Tax Return Error | How to Generate and Upload JSON File For ITR in Income Tax

Показать описание

JSON File Income Tax Return Error | How to Generate and Upload JSON File For ITR in Income Tax

json file income tax return

how to upload json file in income tax return

json file not generated itr

json file income tax return error

json file kaise banaye

how to generate json file for itr

how to create json file

json file not showing in folder

how to download json file from income tax portal

json file upload error in income tax portal

how to create json file for income tax return

how to open json file

itr json file

income tax me json file kaise banaye

----------------------------------------------------------------------------------------------------------------------------------------

json file income tax return

how to upload json file in income tax return

json file not generated itr

json file income tax return error

json file kaise banaye

how to generate json file for itr

how to create json file

json file not showing in folder

how to download json file from income tax portal

json file upload error in income tax portal

how to create json file for income tax return

how to open json file

itr json file

income tax me json file kaise banaye

----------------------------------------------------------------------------------------------------------------------------------------

Uploading JSON File for filing Income Tax Return on New Income Tax Portal 2 0

JSON File Income Tax Return Error | How to Generate and Upload JSON File For ITR in Income Tax

How to download prefilled Json file from Income tax portal.

JSON is not generating from ITR Excel Utility || Complete Solution || ITR - U for AY 2022-23.

How to File Offline Income Tax Return| how to create JSON file for income tax return|

How to open a JSON file on Windows 10 and 11 (step by step)

ITR JSON File uploading | How to upload JSON file in income tax return | ITR filing online 2023-24

How to Create JSON file for Defective Return Notice u/s 139(9) Reply|

How to file Tax Return for AY 2024-2025 : A Session by CA Akshay Tambe

How to upload JSON file on ITR Portal 2. 0 for past date Income tax returns // Offline ITR

Fix JSON File From Excel Utility Of Income Tax Return Is Not Generating/Saving On Windows PC

How to download json file from Income Tax Portal I CA satbir Singh

ITR 2 filing 2024-25 for capital gain/loss on share/mf | How to file ITR 2 online | Stock Market ITR

How to upload ITR json file | ITR json file upload | ITR json file | How to upload ITR | Tax guide .

ITR Filing for AY 2023-24 | ITR Updates | ITR JSON Schema

How to download Pre filled data from income tax | Import prefilled data in ITR Utility | JSON file

JSON not generating while filing ITR through offline utility ft @skillvivekawasthi

Income Tax Offline Utility | Offline Income Tax Return Filing | Income Tax Return Filing Utility

Tax Filing in less than 5 mins (TAMIL) - Income tax return filing 2022-23

How to Upload Json File On Income Tax Portal

How to Download Prefilled Data from New Income Tax portal || Income tax prefilled JSON file download

How to download Pre-filled JSON from the E-filing portal for assessment year 2024-25 #itrfiling

How to Create JSON file in ITR-4 For AY=2023-24/ JSON file not created

How to download ITR utility for AY 2023-24 | ITR utility | Offline JSON ITR utility | Prefilled data

Комментарии

0:00:53

0:00:53

0:06:14

0:06:14

0:00:16

0:00:16

0:04:41

0:04:41

0:11:30

0:11:30

0:00:39

0:00:39

0:03:24

0:03:24

0:03:39

0:03:39

1:22:34

1:22:34

0:00:51

0:00:51

0:01:19

0:01:19

0:03:45

0:03:45

0:13:21

0:13:21

0:02:39

0:02:39

0:02:27

0:02:27

0:03:09

0:03:09

0:03:58

0:03:58

0:05:57

0:05:57

0:04:46

0:04:46

0:02:23

0:02:23

0:03:04

0:03:04

0:01:06

0:01:06

0:03:03

0:03:03

0:04:23

0:04:23