filmov

tv

IRS Interest Going Up to 8%

Показать описание

The IRS is raising the interest rate to 8% on estimated tax underpayments.

Have a question you want to be answered on the show? Call or text 574-222-2000 or leave a comment!

Be sure to stay up to date by following us!

Want more Wise Money™?

Mike Bernard, CFP® offers advisory services through KFG Wealth Management, LLC dba Korhorn Financial Group. This information is for general financial education and is not intended to provide specific investment advice or recommendations. All investing and investment strategies involve risk, including the potential loss of principal. Asset allocation & diversification do not ensure a profit or prevent a loss in a declining market. Past performance is not a guarantee of future results.

Have a question you want to be answered on the show? Call or text 574-222-2000 or leave a comment!

Be sure to stay up to date by following us!

Want more Wise Money™?

Mike Bernard, CFP® offers advisory services through KFG Wealth Management, LLC dba Korhorn Financial Group. This information is for general financial education and is not intended to provide specific investment advice or recommendations. All investing and investment strategies involve risk, including the potential loss of principal. Asset allocation & diversification do not ensure a profit or prevent a loss in a declining market. Past performance is not a guarantee of future results.

IRS Interest Going Up to 8%

Tax help: How much the IRS will charge in interest if you underpay your taxes

IRS Payment Plans, What you need to know!

The I.R.S. Raised the Interest Rates it Charges When You Owe Back Taxes.

IRS Paying Interest on Tax Refunds

Learn the SECRET to Abating Irs Penalties & Interest from a Former IRS Agent!

Yes, the IRS is paying interest on your tax refund

IRS Interest and Penalties

How to Pay IRS Tax in 2025: Simple Step-by-Step Tutorial

Your Money, Your Future: Interest payments from the IRS

IRS Payment Plan Interest Rate - How Much Interest Does the IRS Charge for Installment Agreements

How to Get the IRS to Forgive Your Penalties and Interest - Tax Hack

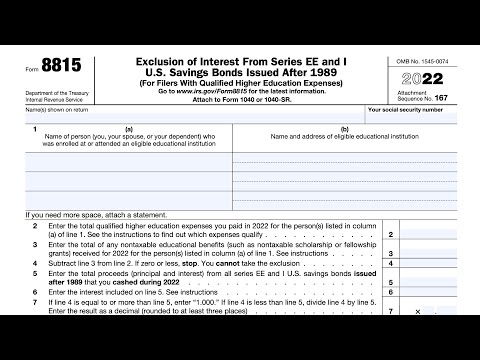

IRS Form 8815 walkthrough (Excluding Interest From Series EE and I Savings Bonds Issued After 1989)

IRS Increases 72(t) Payment Interest Rates

Get IRS Penalties and Interest Waived!

IRS: New Year, New interest Rate On Payments

IRS Penalty and Interest - IRS Income Tax Tips - Loma Risper

Can you remove IRS interest and penalties?

IRS Safe Harbor- What it Is & How to Prevent Underpayment Interest & Penalties #tax

Former IRS Agent Reveals How To Negotiate Your IRS Tax Debt, KNOW THE SYSTEM TO HAVE SUCCESS

Here’s How to Avoid IRS Penalties and Interest

IRS Payment Plans, what to do when you owe.

The IRS is Paying Interest on Employee Retention Tax Credits!

How much Penalties and Interest Does IRS Charge?

Комментарии

0:08:48

0:08:48

0:03:01

0:03:01

0:04:17

0:04:17

0:01:26

0:01:26

0:07:49

0:07:49

0:01:01

0:01:01

0:01:22

0:01:22

0:09:18

0:09:18

0:06:47

0:06:47

0:01:57

0:01:57

0:04:51

0:04:51

0:07:54

0:07:54

0:15:21

0:15:21

0:02:36

0:02:36

0:09:37

0:09:37

0:00:25

0:00:25

0:00:14

0:00:14

0:06:46

0:06:46

0:00:25

0:00:25

0:03:39

0:03:39

0:01:17

0:01:17

0:03:10

0:03:10

0:02:11

0:02:11

0:07:01

0:07:01