filmov

tv

What is the basic difference between GST and Income tax? Simply explained, Check it out!!

Показать описание

Many people confused about the differences between income tax and GST, The main difference between GST and Income tax is, GST is levied on consumption of goods and services whereas Income tax is levied on income earned in a financial year. In way of collecting the tax, GST is the indirect tax paid to the government whereas Income tax is the direct tax paid to the government. we are trying to explain them with simple examples.

What's The Difference Between Shia And Sunni Islam?

Programming vs Coding - What's the difference?

Internet Vs Web? The Basic Difference - WWW Vs Internet?

What is the difference between an Atom, Element, Molecule and Compound?

Electrical vs Electronics - Difference Between Electrical and Electronics

Voltage Explained - What is Voltage? Basic electricity potential difference

Article vs. Section | What is the Difference?

What is the difference between feelings and emotions?

Psychologist Sam Says | Difference between Psychotherapy and Counseling

The Difference Between Speed & Velocity

What is the difference between primary and secondary emotions?

Democrats Vs Republicans | What is the difference between Democrats and Republicans?

Difference between STEP 7 Basic and STEP 7 Professional

Voltage or Potential difference vs EMF | Easiest Explanation | TheElectricalGuy

Difference between Electrical and Electronics in hindi || electronic vs electrical

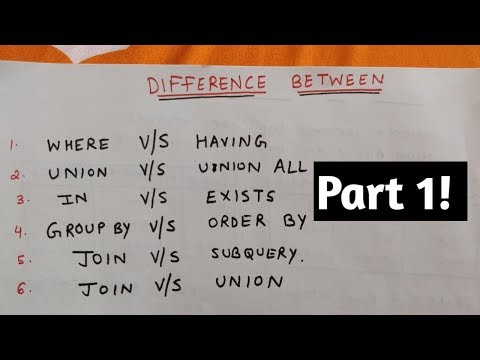

SQL 'difference between' interview questions (part 1)

Difference between Basic & Standard Maths Class 10 CBSE Harsh Sir @VedantuClass9_10_11

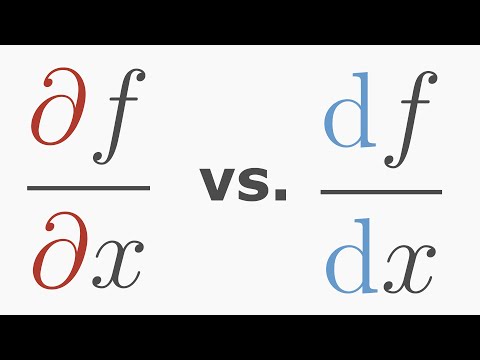

Difference Between Partial and Total Derivative

What is Ms Word, Excel & PowerPoint ll b/w difference in Hindi

Sedan Hatchback SUV Difference

What is UI vs. UX Design? | What's The Difference? | UX/UI Explained in 2 Minutes For BEGINNE...

Difference Between PLC and SCADA || electrical interview question

What's the Difference Between Expressions and Equations?

Using HAVE, HAS and HAD - What’s the difference? English Grammar Tips #shorts #grammar #ananya

Комментарии

0:00:45

0:00:45

0:05:59

0:05:59

0:05:07

0:05:07

0:06:31

0:06:31

0:02:05

0:02:05

0:10:52

0:10:52

0:03:57

0:03:57

0:01:45

0:01:45

0:00:11

0:00:11

0:02:28

0:02:28

0:03:23

0:03:23

0:05:32

0:05:32

0:01:48

0:01:48

0:06:26

0:06:26

0:08:02

0:08:02

0:08:20

0:08:20

0:18:31

0:18:31

0:01:44

0:01:44

0:06:10

0:06:10

0:10:46

0:10:46

0:02:19

0:02:19

0:07:08

0:07:08

0:03:41

0:03:41

0:01:00

0:01:00