filmov

tv

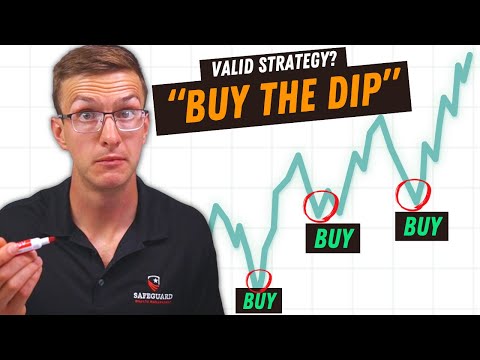

Buy The Dip: High Yield Stocks Getting Way Too Cheap

Показать описание

High-yield stocks have rebounded due to optimism over Federal Reserve rate cuts. However, there remain several high-quality high-yield stocks that have lagged the sector's recovery and remain attractive bargains. We discuss some of them in this video.

Important Disclaimer: This video is impersonal and does not provide individualized advice or recommendations for any specific person. Viewers/readers should not make any investment decision without conducting their own due diligence and consulting their financial advisor about their specific situation. This video is for entertainment purposes only and you are responsible for your own investment decisions. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice.

#stockmarket #passiveincome #dividend #dividendinvesting

Important Disclaimer: This video is impersonal and does not provide individualized advice or recommendations for any specific person. Viewers/readers should not make any investment decision without conducting their own due diligence and consulting their financial advisor about their specific situation. This video is for entertainment purposes only and you are responsible for your own investment decisions. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice.

#stockmarket #passiveincome #dividend #dividendinvesting

Dollar Cost Average vs Buy The Dip (SURPRISING)

High-Yield Dividend King Plunges 20%—Buy the Dip or Stay Away?

High Yield ETF Market DIP! YMAX DOWN! What I'm BUYING Now!

Peter Lynch: The Secret to “Buying the Dip'

BUY THE DIP OR DOLLAR-COST AVERAGE FOR HIGH YIELD DIVIDEND FUNDS? || YIELDMAX DIVIDEND ETFS

The “Buy the Dip” Trading Guide (and what not to do)

Buy The Dip: 10% Dividend Yields Getting Way Too Cheap

ETFs Are Selling Off: Time To Buy The Dip?

One Of The Biggest Buy The Dip Meme Coin Opportunities! CatSlap Is a Crypto Gem!

Surprising Results of BUY THE DIP Strategy on 20 years of Nifty data

Buying the Dip: The Investing Strategy’s Risks and Rewards | WSJ

Should You Buy the Dip?

How to Buy the Dip day trading? Small Account Long Strategy

Don't Buy The Dip!

Stock Market is TOO HIGH - Waiting to invest this next dip.. (S&P 500, SCHD, NASDAQ, Russell 200...

Top Ten Deep Value Stocks For 2025

Why Buying the Dip Is A Terrible Investment Strategy

The BEST 'Buy The Dip' Indicator EVER?📈📉

3 Reasons to BUY the DIP on SCHD (2025)

Don't Buy The Dip (They're Warning Us)

Is This A Better Investing Strategy? - 'Buy The Dip'

Is it a good time to buy the dip now? | Akshat Shrivastava

Is This A Good Strategy - Should You Buy The Dip?

BUY THE DIP - Learn This Profitable Trading Strategy in 20Mins

Комментарии

0:04:03

0:04:03

0:09:25

0:09:25

0:08:59

0:08:59

0:09:12

0:09:12

0:25:02

0:25:02

0:11:09

0:11:09

0:07:55

0:07:55

0:07:22

0:07:22

0:05:48

0:05:48

0:01:00

0:01:00

0:04:49

0:04:49

0:06:14

0:06:14

0:12:15

0:12:15

0:11:24

0:11:24

0:09:09

0:09:09

0:33:15

0:33:15

0:12:13

0:12:13

0:01:00

0:01:00

0:11:21

0:11:21

0:17:42

0:17:42

0:08:04

0:08:04

0:19:56

0:19:56

0:08:19

0:08:19

0:24:03

0:24:03