filmov

tv

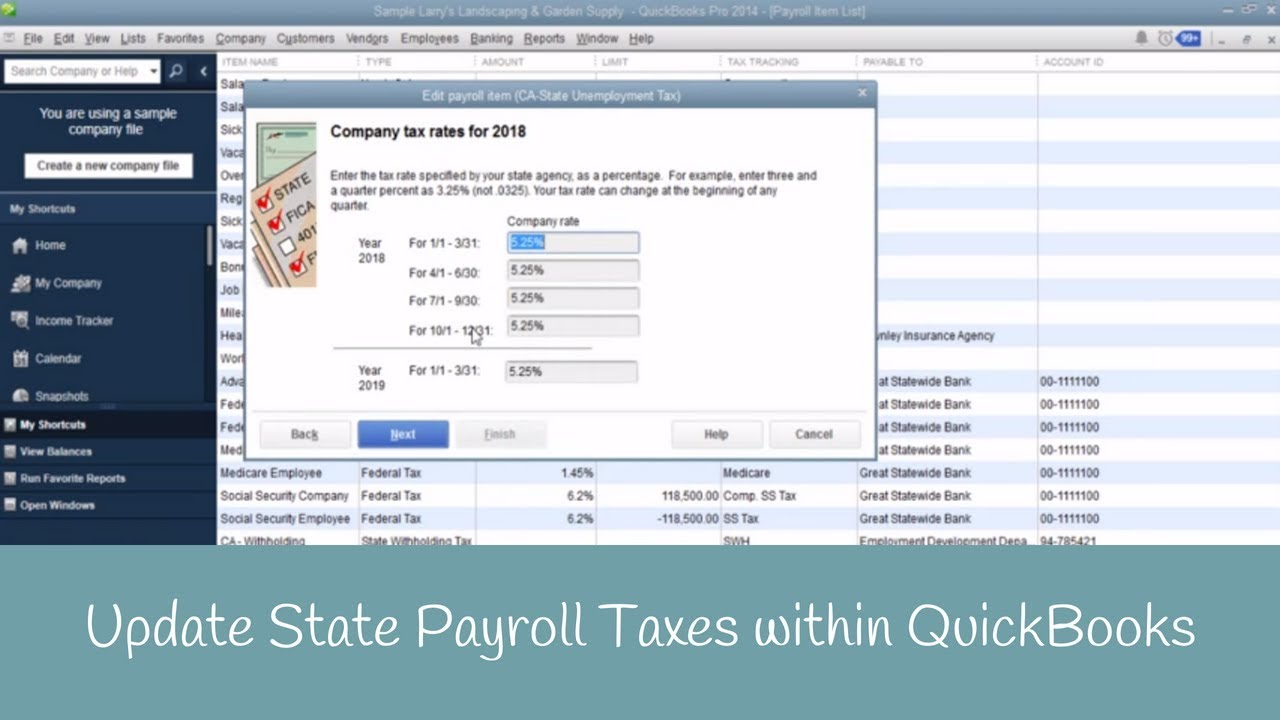

Tip: Update State Payroll Taxes within QuickBooks

Показать описание

People often think QuickBooks updates all of the Payroll Taxes automatically. You have to manually change two of the state taxes in California every year! SUI & ETT.

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe for more QuickBooks tips

Timestamps:

0:00 - Intro

0:13 - Update State Payroll Taxes in QuickBooks

1:48 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer #QuickBooks

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe for more QuickBooks tips

Timestamps:

0:00 - Intro

0:13 - Update State Payroll Taxes in QuickBooks

1:48 - Final Thoughts

I’d love to connect with you 👇

#CandusKampfer #QuickBooks

Tip: Update State Payroll Taxes within QuickBooks

QuickBooks Online Tip - Update Payroll Tax Rate

What are Payroll Taxes? Introduction to Calculating Payroll Taxes with Hector Garcia in 2024

US Payroll Taxes Explained (Everything You Need to Know)

Best Practices for Multi-State Payroll Tax

QuickBooks Online How to update Employer Tax rates for ETT and SUI

Payroll Tax Payments Check Not Showing

How To Avoid Paying Taxes...Legally

Disability Matters at Work: Time Cards, Timesheets and Pay Days on 7th & 22nd for twice a month!

GoldenStateHR Payroll Tax Breakdown

TAXOKAY Tips - Payroll Taxes

QuickBooks Online: How to Run Payroll & Process Payroll Taxes

How to Update and Set State of Unemployment - CA Employers

How To Solve Back Payroll Taxes Problems

Are You Overpaying Taxes? The Best Tax Tips Every 9-5 Employee Must Know!

US Taxation-Tips to understand payroll taxes

Change Payroll Item for Payroll Taxes 7282 QuickBooks Pro Plus Desktop 2022

How the IRS catches you for Tax Evasion

Former Agent's Advice on Back Payroll Taxes

IRS Tax Tip - Filing payroll taxes electronically makes good business sense

Unleashing Employer Income Potential: Unveiling the Power of the IRS Tax Credit for Tips

How to pay yourself when you start an LLC taxed as an S-corp... 💸 Big tax savings tip! #shorts

How to reduce your taxes as a W2 employee

🤷Struggling to understand payroll taxes? #shorts

Комментарии

0:02:03

0:02:03

0:01:01

0:01:01

0:11:06

0:11:06

0:07:45

0:07:45

0:01:46

0:01:46

0:03:34

0:03:34

0:07:30

0:07:30

0:00:41

0:00:41

0:01:46

0:01:46

0:04:16

0:04:16

0:00:34

0:00:34

0:29:42

0:29:42

0:05:35

0:05:35

0:00:36

0:00:36

0:09:27

0:09:27

0:06:48

0:06:48

0:05:59

0:05:59

0:00:54

0:00:54

0:00:57

0:00:57

0:06:45

0:06:45

0:00:14

0:00:14

0:00:50

0:00:50

0:00:14

0:00:14

0:00:41

0:00:41