filmov

tv

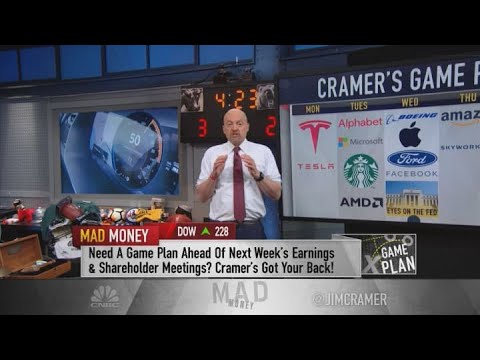

Cramer's week ahead: Tesla, Microsoft, Starbucks, Facebook and more earnings

Показать описание

CNBC’s Jim Cramer said Friday that investors should be ready to find buying opportunities in the stock market with earnings season in full swing.

When companies report quarterly results, market players digest numbers quickly and Wall Street tends to make many mistakes, he said, pointing to trading action in Honeywell and American Express as an example.

“There will be reports next week that are met with negativity and not all of them will be genuinely bad, so I’m urging you to take advantage of that weakness,” the “Mad Money” host said.

With household brand names like Boeing, Microsoft, Starbucks and Amazon set to report, it’s shaping up to be the most brutal stretch of earnings season, he added.

“As we head into the next five days of earnings, you need to think about what gets crushed as much as what is working because this market’s creating some unbelievable buying opportunities,” Cramer said.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Комментарии

0:11:55

0:11:55

0:02:46

0:02:46

0:01:51

0:01:51

0:05:47

0:05:47

0:09:40

0:09:40

0:04:24

0:04:24

0:28:55

0:28:55

0:02:39

0:02:39

0:15:19

0:15:19

0:04:18

0:04:18

0:04:21

0:04:21

0:12:20

0:12:20

0:12:01

0:12:01

0:12:35

0:12:35

0:04:47

0:04:47

0:03:21

0:03:21

0:14:11

0:14:11

0:10:11

0:10:11

0:14:02

0:14:02

0:08:48

0:08:48

0:44:24

0:44:24

0:13:42

0:13:42

0:08:23

0:08:23

0:01:51

0:01:51