filmov

tv

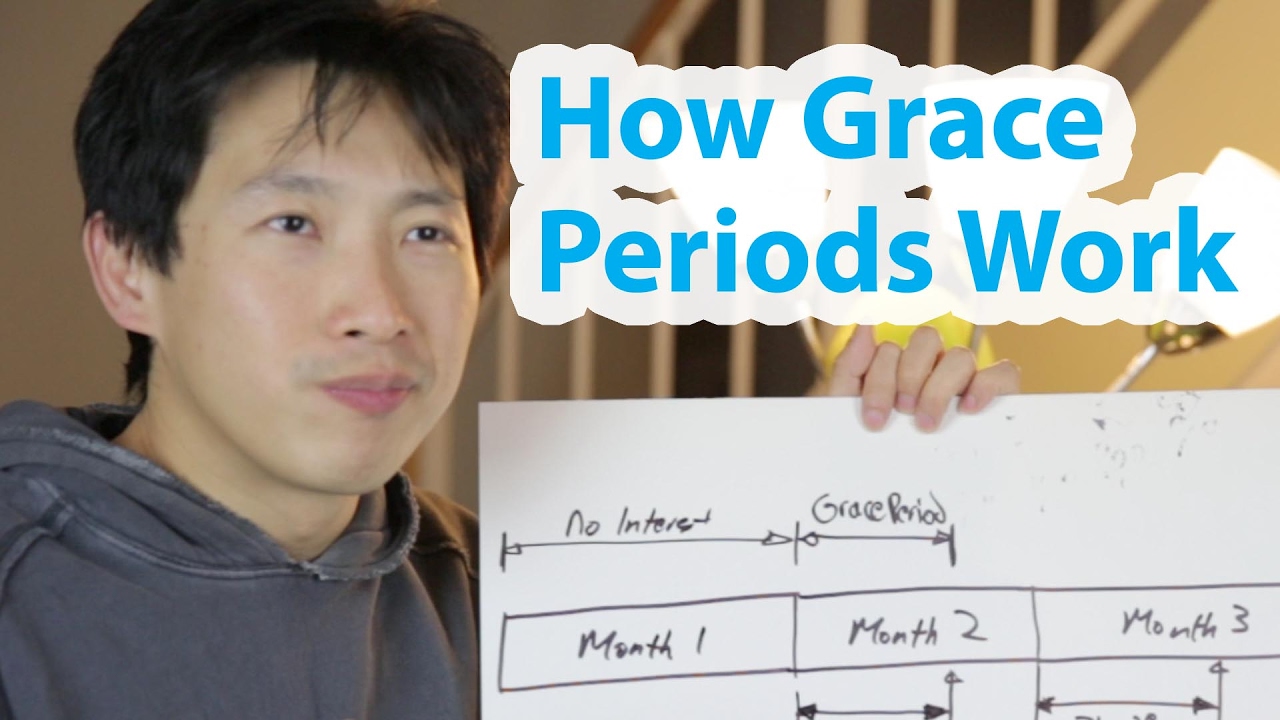

How Credit Card Grace Periods Work

Показать описание

It's mind boggling how complicated they make these credit cards. Let me go through how you can keep your grace period and how to get it back if you loose it.

Other BeatTheBush Channels:

Other BeatTheBush Channels:

How Credit Card Grace Periods Work

How Credit Cards Work: Billing Cycle and 'Grace Period'

What are credit card grace periods?

Credit Card Grace Periods Explained (Credit Cards Part 3/3)

What is a Grace Period Credit Card? (How Does Credit Card Grace Period Work?)

Credit Card Grace Period Explained FAST (Payment Basics 3/4)

What Is a Credit Card Grace Period?

What is My Credit Card Grace Period? | DFI30 Explainer |

How Credit Cards ACTUALLY Work!

Credit card grace periods: Sally's $1 slip

Credit Card Grace Period | No Late Fees If You Delay Credit Card Payments by 3 days | Bankbazaar

What Is Credit Card Grace Period? - CreditGuide360.com

Mastering the Credit Card Grace Period: What You Need to Know

How to master the credit card grace period! #short

What Is A Credit Card Grace Period?

What Is a Credit Card Grace Period?

How To Use Credit Card Grace Period To Save Money

What Is A Credit Card Grace Period? - BusinessGuide360.com

How Credit Cards Work 'Billing Cycle' and 'Grace Period'

I Legally DODGED Credit Card Interest and Fees, Here's How!

How You Can Improve Your Score Using Your Card's Grace Period - Credit Countdown With John Ulzh...

How Credit Card Grace Periods Work

How Does The Grace Period For Credit Card Payments Work on Capital One - Quick & Easy

What is a credit card grace period?

Комментарии

0:07:02

0:07:02

0:02:41

0:02:41

0:01:54

0:01:54

0:03:23

0:03:23

0:02:39

0:02:39

0:02:55

0:02:55

0:02:01

0:02:01

0:02:18

0:02:18

0:03:15

0:03:15

0:01:53

0:01:53

0:01:36

0:01:36

0:02:42

0:02:42

0:01:56

0:01:56

0:00:11

0:00:11

0:00:53

0:00:53

0:02:54

0:02:54

0:07:49

0:07:49

0:01:55

0:01:55

0:04:46

0:04:46

0:02:31

0:02:31

0:07:51

0:07:51

0:00:13

0:00:13

0:00:59

0:00:59

0:03:40

0:03:40