filmov

tv

Types of Financial Analysis

Показать описание

Financial analysis involves using financial data to assess a company’s performance and make recommendations about how it can improve going forward.

Types of Financial Analysis

MANAGEMENT ACCOUNTING|TYPES OF FINANCIAL ANALYSIS|CHAPTER-3|PART-17|HANDWRITTEN NOTES|SSCOACHING||

Analysis of Financial Statements

🔴 3 Minutes! Financial Ratios & Financial Ratio Analysis Explained & Financial Statement An...

Financial ratio analysis

Understanding Financial Analysis: Importance, Types, and Techniques

WHAT ARE THE TYPES 0F FINANCIAL ANALYSIS?

What is FP&A - Financial Planning & Analysis - What do you do? What types of jobs!

'Understanding Stock Market: A Beginner's Guide'

Types of financial analysis

Types of Financial Analysis

Types of Financial Statement Analysis, Methods of Financial Statement Analysis, Horizontal Vertical

Analysis and interpretation/Types of financial analysis/Management Accounting Part 4/Bcom BBA BCA

Financial Ratios for Easy Analysis of Companies! Study Profitability & Leverage - Part 1 | E18

Financial Statement, Financial Statement Analysis, Types, Financial and Management Accounting,

How to do Financial Analysis of a Company ?

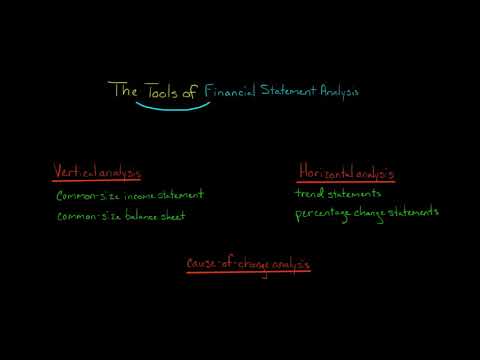

The Tools of Financial Statement Analysis

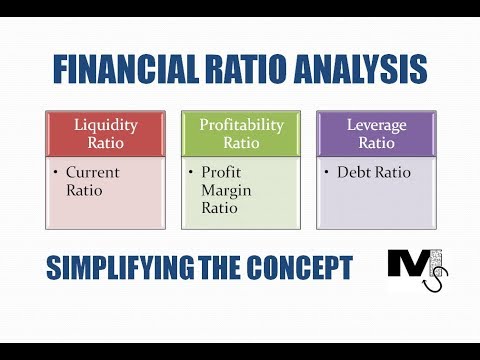

Financial Ratio Analysis - Part 1 - Simplest ever explanation of the concept

Financial analysis

Financial Ratio Analysis【Dr. Deric】

Types of financial analysis

Financial Statements of Company | Types of Financial Statements | 6 Accounting Principles, Concepts

types of Financial Analysis

Ratio Analysis | Financial Statement Analysis | Reading Financial Statements | Commerce Specialist |

Комментарии

0:05:25

0:05:25

0:03:41

0:03:41

0:02:07

0:02:07

0:02:55

0:02:55

0:10:09

0:10:09

0:05:48

0:05:48

0:13:14

0:13:14

0:13:13

0:13:13

0:00:26

0:00:26

0:00:38

0:00:38

0:06:18

0:06:18

0:03:24

0:03:24

0:33:16

0:33:16

0:38:45

0:38:45

0:34:49

0:34:49

0:35:54

0:35:54

0:10:50

0:10:50

0:06:30

0:06:30

0:09:50

0:09:50

0:25:11

0:25:11

0:11:41

0:11:41

0:09:08

0:09:08

0:11:39

0:11:39

0:53:07

0:53:07