filmov

tv

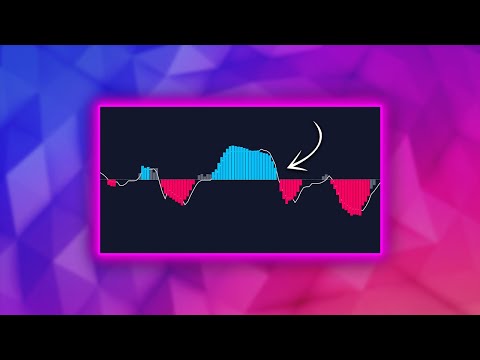

SIMPLE Trading Strategy | Using Options Gamma

Показать описание

In this video, I share a trade idea on SBUX using options gamma as my guide to making the best decision possible. Stock options gamma is the risk that the market maker has when he takes the other side of your options trades so understanding its importance is critical to your stock and options trading success.

About me👨🏻💻: Steve Patterson is one of the Top Proprietary Traders in the world, he has worked with 5 of the largest prop firms and he has a long history as one of the most dedicated trading educators.

He has survived, adapted and ultimately prospered over his 37+ year career. He believes that in order to be a successful coach, you have to experience the highs and lows. He's in a unique position than his competitors based on his vast background and knowledge within the industry.

His goal is to transfer his experience to help you save years of frustration and sleepless nights. He's excited to share everything that he's learned from his extensive background and finally help you build the financial future that you've dreamed about for you and your loved ones.

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

Become Profitable With This SIMPLE Trading Strategy

The Simplest Day Trading Strategy for Beginners (with ZERO experience)

Super Effective but Not So Simple Trading Strategy

Simple Millionaire Crypto Trading Strategy (EASY To Implement!!)

BEST MACD Trading Strategy [86% Win Rate]

The Heikin Ashi Trading Strategy (Simple & Effective)

The Simplest Trading Strategy Ever: Trading With the Trend

How One Funded Account Made Me $40k + Simple Trading Strategy

EASY Scalping Strategy For Day Trading (High Win Rate Strategy)

How I Earn A Living With This Simple Trading Strategy

Revealing My SUPER SIMPLE TRADING STRATEGY That Made Me $11,000

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

Simple Trading Strategy That 'Turned $1000 into $50000' Tested 100 Times - Bollinger Bands...

THE BEST FOREX TRADING STRATEGY | KEEP IT SIMPLE

My SIMPLE & PROFITABLE Trend Following Trading Strategy!

Bollinger Band + RSI Trading Strategy That Actually Works

Easy ICT Trend Following Trading Strategy That Works!

The ONLY FOREX Trading Strategy You Will EVER Need

BEST Trend Lines Strategy for Daytrading Forex & Stocks (Simple Technique)

I Tested This Trading Strategy & It Made 310%

Four Price Action Secrets (The Ultimate Guide To Price Action)

Simplest Day Trading Strategy for Beginners

This Is The SUPER SIMPLE Trading Strategy Made Me $10,340

Комментарии

0:07:22

0:07:22

0:14:25

0:14:25

0:18:26

0:18:26

0:11:49

0:11:49

0:16:55

0:16:55

0:07:06

0:07:06

0:06:05

0:06:05

0:01:54

0:01:54

0:12:27

0:12:27

0:04:35

0:04:35

0:10:27

0:10:27

0:10:07

0:10:07

0:00:39

0:00:39

0:08:11

0:08:11

0:16:42

0:16:42

0:19:09

0:19:09

0:06:41

0:06:41

0:23:27

0:23:27

0:14:47

0:14:47

0:09:25

0:09:25

0:01:00

0:01:00

0:08:11

0:08:11

0:08:29

0:08:29

0:13:27

0:13:27