filmov

tv

How to Calculate CAGR in Excel | Compound Annual Growth Rate

Показать описание

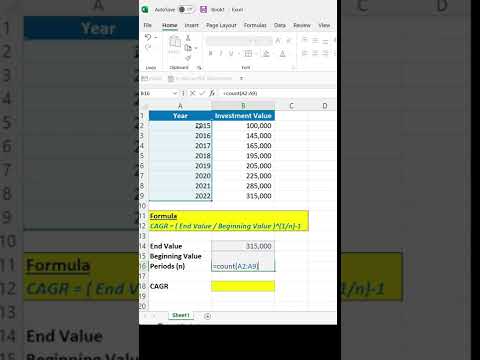

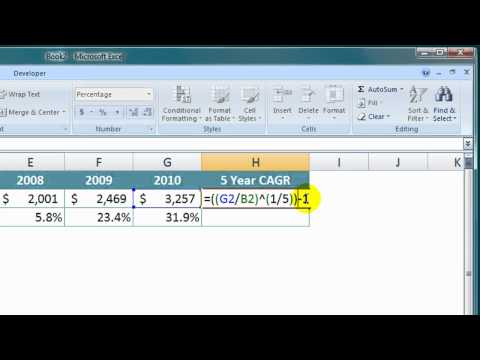

CAGR (compound annual growth rate) is the return required to grow an investment's beginning value to its future value over a given number of years. CAGR is the measure of an investment's growth over time. CAGR includes compound interest and is thus superior to average annual returns.

You can calculate the CAGR either from annual returns or from account balances.

CAGR Topics in this video:

📌 Total Return

📌 Average Annual Return

📌 Compound Annual Growth Rate (CAGR)

📌 Calculate CAGR in Excel using the Formula

📌 Calculate CAGR in Excel using the RATE Excel Function

📌 Calculate CAGR in Excel using the RRI Excel Function

MENTIONED IN THIS VIDEO

__________

LEARN MORE

__________

BOOKS I RECOMMEND

__________

SAY HI ON SOCIAL

__________

MY GEAR

__________

CHAPTERS

00:00 Introduction

00:45 Annual Returns

01:30 Total Return

02:25 Average Return

03:09 CAGR Formula

05:40 CAGR Rules

06:15 CAGR from Annual Returns

08:45 RATE and RRI Functions

10:40 CAGR from Account Balances

12:25 CAGR from Account Balances with Annual Investments

14:00 CAGR from Account Balances with Annual Withdrawals

__________

ABOUT ME

__________

DISCLAIMERS & DISCLOSURES

This content is for education and entertainment purposes only. Finally Learn does not provide accounting, tax, financial planning, or investment advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. All investing involves risk, including the possible loss of principal.

#finallylearn #jeffmankin #cagr

364 Subscribers

04/03/2021

You can calculate the CAGR either from annual returns or from account balances.

CAGR Topics in this video:

📌 Total Return

📌 Average Annual Return

📌 Compound Annual Growth Rate (CAGR)

📌 Calculate CAGR in Excel using the Formula

📌 Calculate CAGR in Excel using the RATE Excel Function

📌 Calculate CAGR in Excel using the RRI Excel Function

MENTIONED IN THIS VIDEO

__________

LEARN MORE

__________

BOOKS I RECOMMEND

__________

SAY HI ON SOCIAL

__________

MY GEAR

__________

CHAPTERS

00:00 Introduction

00:45 Annual Returns

01:30 Total Return

02:25 Average Return

03:09 CAGR Formula

05:40 CAGR Rules

06:15 CAGR from Annual Returns

08:45 RATE and RRI Functions

10:40 CAGR from Account Balances

12:25 CAGR from Account Balances with Annual Investments

14:00 CAGR from Account Balances with Annual Withdrawals

__________

ABOUT ME

__________

DISCLAIMERS & DISCLOSURES

This content is for education and entertainment purposes only. Finally Learn does not provide accounting, tax, financial planning, or investment advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. All investing involves risk, including the possible loss of principal.

#finallylearn #jeffmankin #cagr

364 Subscribers

04/03/2021

Комментарии

0:02:22

0:02:22

0:05:44

0:05:44

0:07:45

0:07:45

0:00:55

0:00:55

0:16:50

0:16:50

0:08:32

0:08:32

0:03:17

0:03:17

0:01:42

0:01:42

0:04:01

0:04:01

0:03:37

0:03:37

0:01:24

0:01:24

0:04:10

0:04:10

0:07:03

0:07:03

0:00:40

0:00:40

0:04:24

0:04:24

0:02:24

0:02:24

0:03:51

0:03:51

0:01:58

0:01:58

0:04:18

0:04:18

0:09:30

0:09:30

0:14:26

0:14:26

0:03:45

0:03:45

0:03:51

0:03:51

0:02:58

0:02:58