filmov

tv

Excel: Calculating Compound Annual Growth Rate (CAGR) - Five methods

Показать описание

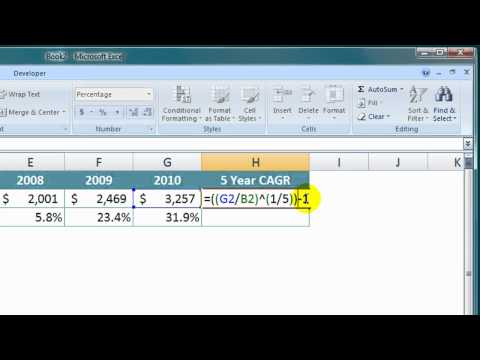

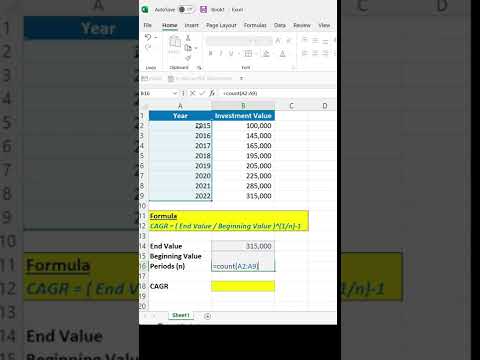

I demonstrate five different methods for calculating the compound annual growth rate (CAGR) with Excel, including manual calculations and Excel formulas. I also explain the rule of 72, an essential financial rule useful for estimating the time it takes for an investment to double.

As a bonus, I show a formula to figure out the future value of an amount without manual calculations.

Chapters:

00:00 Introduction

00:34 Setting up the Example Scenario

02:23 Applying the Rule of 72

03:50 Calculating CAGR: Manual Method

04:03 Calculating CAGR: Using Formulas and Excel Functions

06:51 Predicting Future Value of Investment

08:30 Addressing Market Fluctuations and Conclusion

My Excel Courses and Microsoft Teams course can be found here:

And make sure you subscribe to my channel!

-- EQUIPMENT USED ---------------------------------

-- SOFTWARE USED ---------------------------------

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links I provide, I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel, so I can continue to provide you with free content each week!

#excel #chrismenard #cagr

As a bonus, I show a formula to figure out the future value of an amount without manual calculations.

Chapters:

00:00 Introduction

00:34 Setting up the Example Scenario

02:23 Applying the Rule of 72

03:50 Calculating CAGR: Manual Method

04:03 Calculating CAGR: Using Formulas and Excel Functions

06:51 Predicting Future Value of Investment

08:30 Addressing Market Fluctuations and Conclusion

My Excel Courses and Microsoft Teams course can be found here:

And make sure you subscribe to my channel!

-- EQUIPMENT USED ---------------------------------

-- SOFTWARE USED ---------------------------------

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links I provide, I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel, so I can continue to provide you with free content each week!

#excel #chrismenard #cagr

Комментарии

0:02:22

0:02:22

0:09:30

0:09:30

0:00:34

0:00:34

0:03:37

0:03:37

0:01:24

0:01:24

0:00:55

0:00:55

0:11:23

0:11:23

0:01:37

0:01:37

0:02:17

0:02:17

0:00:29

0:00:29

0:00:19

0:00:19

0:16:50

0:16:50

0:03:51

0:03:51

0:00:40

0:00:40

0:03:58

0:03:58

0:08:32

0:08:32

0:03:51

0:03:51

0:02:04

0:02:04

0:04:24

0:04:24

0:01:32

0:01:32

0:07:45

0:07:45

0:06:26

0:06:26

0:10:23

0:10:23

0:00:58

0:00:58