filmov

tv

UK Self Assessment Tax Return - DEEP DIVE!

Показать описание

It’s that time of year again! Time to fill in my Self Assessment tax return in the UK. In this video I’m going to take a bit of a deeper dive including things asked for in the past such as bank interest, dividends, capital gains tax etc. Remember I’m not an accountant - always get an accountant to help with your first couple of returns until you know what you’re doing.

Here's some affiliate links to services I use or would consider using. If you think they would be a good match for your business please use these links - many include offers exclusive to this channel. Read more about affiliate links at the bottom of this description:

⚠️ Disclaimer ⚠️

Tax return chapters:

00:00 - Introduction

02:50 - Log in to Government Gateway

03:55 - Personal information

04:15 - Tailor the tax return

07:40 - Employment section

10:00 - Taxable benefits

10:39 - Self employment section

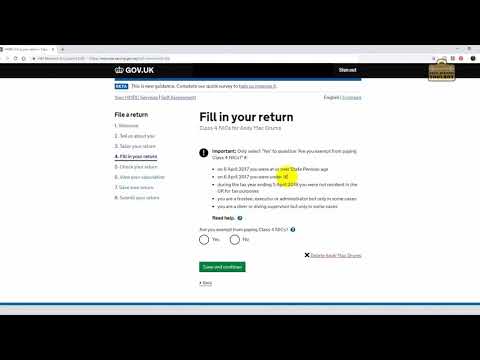

17:50 - Class 2 NI

20:00 - Capital Gains Tax section

22:35 - Savings interest section

24:25 - Dividends section

24:55 - PAYE coding and final info

27:20 - Calculation overview

29:40 - Detailed tax calculation overview

35:04 - Payments on account

36:55 - Deleting your tax return

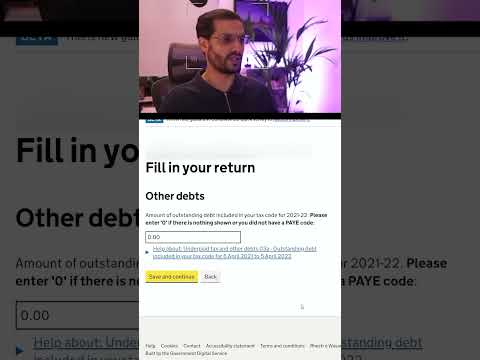

All content on this channel is exclusively owned by MacLellan Creative Limited. Copyright (c) 2024. All rights reserved.

#smallbusiness #tax #selfemployed

Here's some affiliate links to services I use or would consider using. If you think they would be a good match for your business please use these links - many include offers exclusive to this channel. Read more about affiliate links at the bottom of this description:

⚠️ Disclaimer ⚠️

Tax return chapters:

00:00 - Introduction

02:50 - Log in to Government Gateway

03:55 - Personal information

04:15 - Tailor the tax return

07:40 - Employment section

10:00 - Taxable benefits

10:39 - Self employment section

17:50 - Class 2 NI

20:00 - Capital Gains Tax section

22:35 - Savings interest section

24:25 - Dividends section

24:55 - PAYE coding and final info

27:20 - Calculation overview

29:40 - Detailed tax calculation overview

35:04 - Payments on account

36:55 - Deleting your tax return

All content on this channel is exclusively owned by MacLellan Creative Limited. Copyright (c) 2024. All rights reserved.

#smallbusiness #tax #selfemployed

Комментарии

0:03:32

0:03:32

0:14:35

0:14:35

0:02:33

0:02:33

0:38:42

0:38:42

0:14:18

0:14:18

0:46:27

0:46:27

0:02:11

0:02:11

0:15:37

0:15:37

0:15:10

0:15:10

0:48:57

0:48:57

0:02:47

0:02:47

0:28:07

0:28:07

0:46:47

0:46:47

0:14:59

0:14:59

0:01:44

0:01:44

0:00:12

0:00:12

0:00:57

0:00:57

0:00:49

0:00:49

0:04:02

0:04:02

0:10:28

0:10:28

0:01:20

0:01:20

0:00:27

0:00:27

0:05:43

0:05:43

0:41:00

0:41:00