filmov

tv

Tax Reductions through Cost Segregation | Small Business Webcast

Показать описание

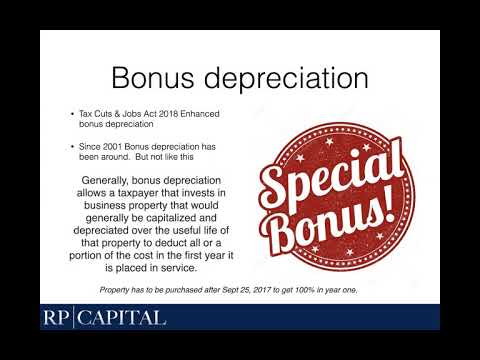

In this Webcast, Seattle CPA John Huddleston, and Todd Grabowski, will discuss the financial benefits of Cost Segregation.

They will address how such an analysis can reduce the tax burdens associated with commercial and residential rental Real Estate investments. Often, a taxpayer can garner additional tax savings in the tens of thousands through this process. This can also completely change to ROI on a proposed investment property. If you plan to, or are currently acquiring a building, or have acquired a building in the last decade, this is a learning opportunity that can save you tax dollars and maximize your tax deductions.

Additional Information Here

About Us

Huddleston Tax CPAs is an experienced, trusted firm in the Seattle area focused on serving the tax and accounting needs of small business owners.

We offer business accounting services such as Tax Preparation, Quickbooks consulting, Bookkeeping & Payroll, and Small Business Coaching and more.

Visit Our Site

Connect With Us

Contact Us

1-(800) 376-1785

They will address how such an analysis can reduce the tax burdens associated with commercial and residential rental Real Estate investments. Often, a taxpayer can garner additional tax savings in the tens of thousands through this process. This can also completely change to ROI on a proposed investment property. If you plan to, or are currently acquiring a building, or have acquired a building in the last decade, this is a learning opportunity that can save you tax dollars and maximize your tax deductions.

Additional Information Here

About Us

Huddleston Tax CPAs is an experienced, trusted firm in the Seattle area focused on serving the tax and accounting needs of small business owners.

We offer business accounting services such as Tax Preparation, Quickbooks consulting, Bookkeeping & Payroll, and Small Business Coaching and more.

Visit Our Site

Connect With Us

Contact Us

1-(800) 376-1785

0:43:59

0:43:59

0:09:08

0:09:08

0:00:42

0:00:42

0:17:25

0:17:25

0:40:03

0:40:03

0:01:00

0:01:00

0:23:44

0:23:44

0:11:08

0:11:08

0:54:07

0:54:07

0:44:23

0:44:23

0:08:42

0:08:42

0:37:52

0:37:52

0:04:09

0:04:09

0:00:42

0:00:42

0:00:43

0:00:43

1:17:30

1:17:30

0:48:15

0:48:15

1:20:39

1:20:39

0:00:58

0:00:58

0:14:20

0:14:20

0:01:58

0:01:58

0:26:08

0:26:08

0:03:54

0:03:54

0:00:54

0:00:54