filmov

tv

Z-spread, zero-volatility spread (for the @CFA Level 1 exam)

Показать описание

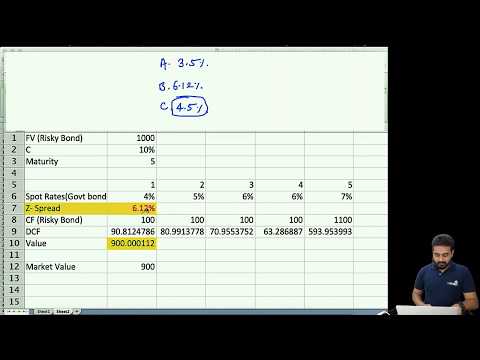

Z-spread, zero-volatility spread (for the @CFA Level 1 exam) explores the valuation of a corporate bond, given a set of benchmark spot rates and a Z-spread.

Z-spread, zero-volatility spread (for the @CFA Level 1 exam)

Z-Spread| Zero-Volatility Spread|Option-Adjusted Spread (OAS)/ Fixed Income

CFA level I: Fixed Income - G- spread, Z- spread, OAS

CFA Level 1 Fixed Income: Zero-volatility & Option-Adjusted Spreads

Option Adjusted Spread

CFA Level 2 Exam Fixed Income: Factors Affecting OAS

CFA Level 1 Mini-Lesson: Corporate Bonds & Z-Spreads (aka Zero Volatility Spread or Static Sprea...

Z-spread - CFA Level1 practice question

CFA Level 2 Fixed Income Swap Spread and Z Spread Part 2

Relationship - Z Spread & Bond Spreads !!

Z-spread and OAS

CFA Level I Yield Measures Spot and Forward Rates Video Lecture by Mr. Arif Irfanullah part 4

Kaplanlearn Module 27 4 Option Adjusted Spread

Fixed Income Derivatives - Options Adjusted Spread (OAS)

Z Spread Example

Option Adjusted Spread - Super Stocks Market Concepts

Z spread

Option-Adjusted Spread - Super Stocks Market Concepts

Z spread

Lecture 15: Z Spread & Option Adjusted Spread (OAS)

FI: Los 44.4 G-Spread n Z-Spread

How Does Volatility Affect Vertical Spreads?

Bond Spreads Explained | Financial Fundamentals

Valuation of Z Spreads !!

Комментарии

0:08:20

0:08:20

0:10:09

0:10:09

0:27:13

0:27:13

0:26:07

0:26:07

0:14:05

0:14:05

0:04:41

0:04:41

0:05:17

0:05:17

0:03:43

0:03:43

0:02:38

0:02:38

0:10:11

0:10:11

0:11:16

0:11:16

0:19:35

0:19:35

0:20:25

0:20:25

0:10:42

0:10:42

0:04:32

0:04:32

0:00:11

0:00:11

0:01:39

0:01:39

0:00:10

0:00:10

0:04:47

0:04:47

0:34:23

0:34:23

0:05:59

0:05:59

0:08:58

0:08:58

0:02:12

0:02:12

0:12:39

0:12:39