filmov

tv

Tax Diversification Explained

Показать описание

🔥 Building a robust nest egg is crucial, but it's equally important to have a tax diversified nest egg. 🏦💰 Why? Because how your money is taxed can greatly impact your retirement savings. 💡💸 In this video, we'll explore why tax diversification matters and how it can benefit you. 🌟

💡 When we save money, we often overlook the fact that different types of income are taxed differently. However, this becomes a significant consideration when we reach retirement age. Especially if you retire before 65 and are on an ACA plan, understanding the tax implications of your withdrawals is crucial. 📈💰

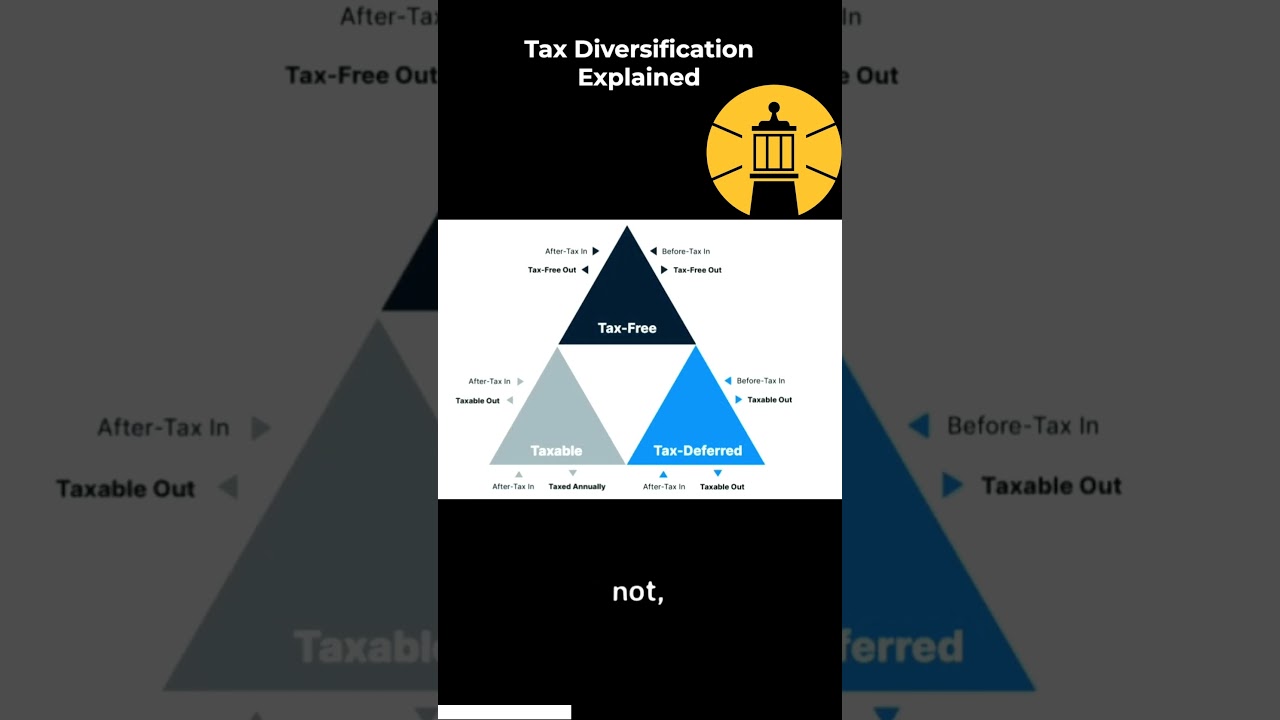

💡 Let's take a closer look at the graphic in this video, which illustrates how money is taxed in various ways. If all your retirement income is taxable, you may end up losing out on valuable subsidies. 😱💔 So, it's essential to be mindful of the kind of money you're withdrawing.

💡 The same applies to Medicare and dealing with irmaa. By incorporating tax-free money into your retirement plan, such as building a Roth bucket early on, you can gain a significant advantage. 🌟💼

💡 Join us as we delve deeper into the importance of tax diversification and how it can help secure your financial future. 💪💼 Don't miss out on this valuable information! Hit that like button and subscribe to our channel for more insightful content. 🎥🔔

#TaxDiversification #RetirementPlanning #FinancialSecurity #Shorts

💡 When we save money, we often overlook the fact that different types of income are taxed differently. However, this becomes a significant consideration when we reach retirement age. Especially if you retire before 65 and are on an ACA plan, understanding the tax implications of your withdrawals is crucial. 📈💰

💡 Let's take a closer look at the graphic in this video, which illustrates how money is taxed in various ways. If all your retirement income is taxable, you may end up losing out on valuable subsidies. 😱💔 So, it's essential to be mindful of the kind of money you're withdrawing.

💡 The same applies to Medicare and dealing with irmaa. By incorporating tax-free money into your retirement plan, such as building a Roth bucket early on, you can gain a significant advantage. 🌟💼

💡 Join us as we delve deeper into the importance of tax diversification and how it can help secure your financial future. 💪💼 Don't miss out on this valuable information! Hit that like button and subscribe to our channel for more insightful content. 🎥🔔

#TaxDiversification #RetirementPlanning #FinancialSecurity #Shorts

0:00:59

0:00:59

0:08:23

0:08:23

0:09:13

0:09:13

0:02:02

0:02:02

0:01:50

0:01:50

0:01:48

0:01:48

0:07:25

0:07:25

0:38:25

0:38:25

0:00:44

0:00:44

0:03:41

0:03:41

0:11:17

0:11:17

0:14:45

0:14:45

0:24:55

0:24:55

0:42:45

0:42:45

0:11:55

0:11:55

0:11:05

0:11:05

0:15:43

0:15:43

0:00:59

0:00:59

0:03:11

0:03:11

0:01:33

0:01:33

0:03:47

0:03:47

0:06:11

0:06:11

0:11:10

0:11:10

0:18:03

0:18:03