filmov

tv

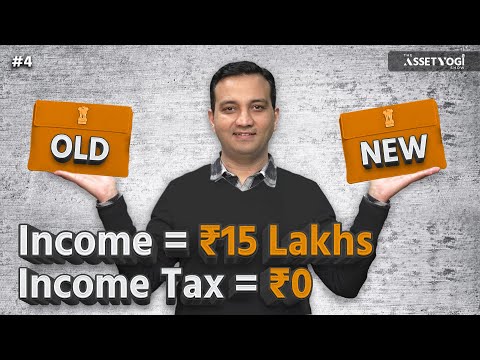

Income Tax Slab Rates - How to Calculate Income Tax FY 2022-23

Показать описание

In India, we follow a progressive income tax policy. This implies that high-income earners are taxed more than low-income ones. If you are a salaried employee or business owner, you are liable to pay Income Tax depending on your annual income and tax bracket. I’m sure you are aware of this, but do you know how exactly is your income tax calculated based on the tax slab rates. Let's discuss in this video with the help of a numerical example.

Tax is a source of revenue for the Government. Taxes collected are utilized on defence & military of the nation, to provide infrastructure & sanitation facilities, and to spend on social welfare causes.

Broadly speaking, there are two types of taxes :

- Direct Tax - Collected on the income or wealth of the taxpayer (eg. Income Tax)

- Indirect Tax - Paid by the consumer on the purchase of goods & services (eg. GST)

In this learning video, we will only discuss about direct taxes, i.e. income tax and we will understand the computation of income tax of an individual taxpayer based on the tax slab rates. We will study in detail how the tax is calculated for an individual with an annual income of ₹ 18 lakhs, as per the new tax regime. Note that the new tax regime has lower rates for tax slabs, but you have to forgo various tax exemptions and deductions otherwise available.

#incometax #incometaxindia #incometaxreturn #incometaxslab #incometaxcalculation #personalfinance #tax #finance #business #investing #financialliteracy #financialfreedom #theperfectportfolio

-------------------------------------------------x-------------------------------------------------

Follow us on Instagram:

Follow us on Twitter:

Follow us on Reddit:

Tax is a source of revenue for the Government. Taxes collected are utilized on defence & military of the nation, to provide infrastructure & sanitation facilities, and to spend on social welfare causes.

Broadly speaking, there are two types of taxes :

- Direct Tax - Collected on the income or wealth of the taxpayer (eg. Income Tax)

- Indirect Tax - Paid by the consumer on the purchase of goods & services (eg. GST)

In this learning video, we will only discuss about direct taxes, i.e. income tax and we will understand the computation of income tax of an individual taxpayer based on the tax slab rates. We will study in detail how the tax is calculated for an individual with an annual income of ₹ 18 lakhs, as per the new tax regime. Note that the new tax regime has lower rates for tax slabs, but you have to forgo various tax exemptions and deductions otherwise available.

#incometax #incometaxindia #incometaxreturn #incometaxslab #incometaxcalculation #personalfinance #tax #finance #business #investing #financialliteracy #financialfreedom #theperfectportfolio

-------------------------------------------------x-------------------------------------------------

Follow us on Instagram:

Follow us on Twitter:

Follow us on Reddit:

Комментарии

0:05:27

0:05:27

0:08:44

0:08:44

0:07:28

0:07:28

0:13:35

0:13:35

0:13:13

0:13:13

0:02:58

0:02:58

0:11:06

0:11:06

0:20:11

0:20:11

0:11:48

0:11:48

0:02:44

0:02:44

0:11:02

0:11:02

0:35:09

0:35:09

0:11:36

0:11:36

0:10:40

0:10:40

0:05:58

0:05:58

0:12:17

0:12:17

0:00:10

0:00:10

0:02:29

0:02:29

0:19:23

0:19:23

0:10:28

0:10:28

0:18:29

0:18:29

0:02:32

0:02:32

0:12:14

0:12:14

0:22:57

0:22:57