filmov

tv

Calculating Payback Period

Показать описание

Simple payback period calculation for IB Business.

IB Business - 3.2 Investment Appraisal.

IB Business - 3.2 Investment Appraisal.

Payback period

Payback period explained

How to Calculate Payback Period and Discounted Payback Period

Calculating Payback Period

Payback Period Method Example

How to calculate PAYBACK PERIOD in MS Excel Spreadsheet 2019

Payback Period | Explained With Examples

#2 Payback Period - Investment Decision - Financial Management ~ B.COM / BBA / CMA

PayBack Period - Meaning, Concept, Formula, Calculation, Explained with Example.

Payback Period (Investment Appraisal)

Episode 129: How to Calculate the Payback Period

Payback and Discounted Payback Period in Excel

3.8 INVESTMENT APPRAISAL / IB BUSINESS MANAGEMENT / PBP, ARR, NPV

Payback Period | Explained with Examples | Lesson 2

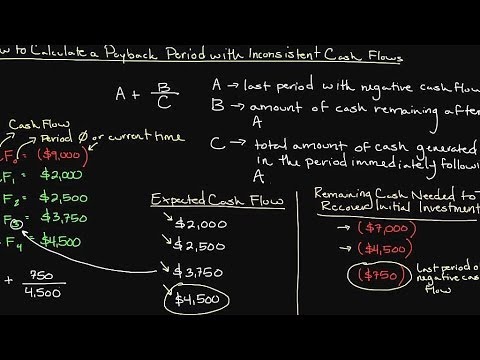

How to Calculate a Payback Period with Inconsistent Cash Flows

🔴 3 Minutes! Payback Period Explained. What is Payback Period?

A level Business Revision - Payback Method of Investment Appraisal

MA43 - Net Present Value, Payback Period, and IRR Sample Problem

Discounted Payback Period Method

Payback Period - Basics, Formula, Calculations in Excel (Step by Step)

Calculate the Payback Period in 30 seconds!

Payback Period: Formula & How to Calculate Payback Period

Payback Period (PBP) Calculation - Selection/Decision Criteria of Project Management.

INVESTMENT APPRAISAL (PART 1)

Комментарии

0:08:26

0:08:26

0:03:24

0:03:24

0:04:21

0:04:21

0:07:42

0:07:42

0:05:02

0:05:02

0:02:50

0:02:50

0:19:34

0:19:34

0:13:37

0:13:37

0:03:07

0:03:07

0:09:24

0:09:24

0:03:33

0:03:33

0:09:18

0:09:18

0:29:05

0:29:05

0:21:52

0:21:52

0:05:07

0:05:07

0:03:01

0:03:01

0:10:41

0:10:41

0:14:02

0:14:02

0:05:04

0:05:04

0:15:59

0:15:59

0:00:35

0:00:35

0:03:48

0:03:48

0:10:07

0:10:07

0:33:30

0:33:30