filmov

tv

GST - Interest on Delay Payment of Tax - Section 50

Показать описание

Explanation in EASYWAY!!!!!!!!!!!!!!!

Section 50 – Interest calculation on delay payment of tax

Interest is payable when there is a delay in payment of Tax.

Rate of interest is 18% p.a.

Interest is payable from Date after the due date of payment till the date of actual payment of Tax. ( eg. If due date is 20th June, so interest calculation starts from 21st June)

Interest payable shall be debited to E-Credit Ledger.

Interest payable shall be discharged from E-Cash Ledger.

If registered person filed his return BELATEDLY – Interest is payable on Tax which is paid through E-Cash Ledger Only. (Net Cash Libility)

Section 50 – Interest calculation on delay payment of tax

Interest is payable when there is a delay in payment of Tax.

Rate of interest is 18% p.a.

Interest is payable from Date after the due date of payment till the date of actual payment of Tax. ( eg. If due date is 20th June, so interest calculation starts from 21st June)

Interest payable shall be debited to E-Credit Ledger.

Interest payable shall be discharged from E-Cash Ledger.

If registered person filed his return BELATEDLY – Interest is payable on Tax which is paid through E-Cash Ledger Only. (Net Cash Libility)

GST INTEREST PENALTY WAIVER NEW FORMS AND PROCESS

Interest & Penalty waiver Scheme in GST| DRC 01| DRC 01A| DRC 07| BUDGET 2024 UPDATE

GST Returns Late Fee and Interest Calculation | GST Act | Extended Due Date 2020 | CGST Notification

How to Calculate Late Fees and Interest in GST? || Know all about Late Fees and Interest in GST||

Interest on Delayed Payment of GST and wrongly availed Credit || CA Bimal Jain

Interest calculation on late payment of gst | #gst #gstinterest #shorts

GST - Interest on Delay Payment of Tax - Section 50

How To GST Interest/fees/penalties under section 50 How to Calculate Interest on late payment of GST

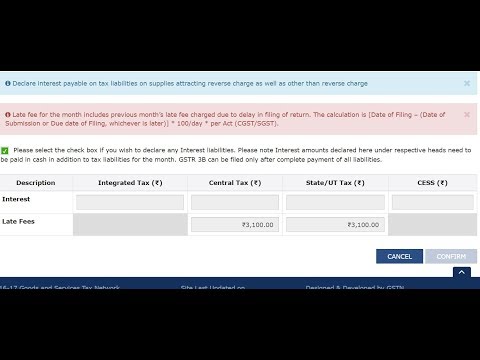

how to pay late fee and interest in gst portal

GST Interest Notice Payment Online | GST Interest Notice Reply U/s 50 on Late Filing of GST return.

GST Interest On Late Payment | GST Interest Calculator 2023 #gst

GST Interest for Late Payment & Late fees for delay in filing of GST Return

HOW TO CALCULATE INTEREST ON LATE FILING OF GST RETURN | GST CIRCULAR | GST INTEREST CALCULATION

HOW TO CALCULATE GST INTEREST AS PER NEW RULES|GST INTEREST ON LATE FILING OF GSTR3B|

Sec 50 (1) (3) Rule 88B Interest Liability in Gst

Calculation of GST Interest | Auto populated GST Interest in GSTR 3B

GST INTEREST NEW CALCULATION|GST QRMP SCHEME AND INTEREST CALCULATION

Interest On Delayed Payment Of GST | Most Important Amendment | CA Inter CMA Inter | CS Executive

Delay in filing GST returns, Late fees and huge interest

GST INTEREST CALCULATOR - HOW TO CALCULATE INTEREST IN GSTR3B EASILY

Late Fee & Interest for Pending returns & Future returns | 43rd GST Council Meeting in Tamil...

GST LATE FEES & INTEREST WAIVED & REFUNDED IN PORTAL

GST Interest on Delayed Payment / Refund : GST News 296

GST Late fees and interest on delay of filing GSTR-3B tax liability Calculator || True Calculator

Комментарии

0:08:04

0:08:04

0:15:53

0:15:53

0:01:12

0:01:12

0:08:24

0:08:24

0:04:09

0:04:09

0:00:56

0:00:56

0:06:46

0:06:46

0:05:46

0:05:46

0:01:14

0:01:14

0:09:31

0:09:31

0:07:09

0:07:09

0:18:03

0:18:03

0:11:25

0:11:25

0:10:21

0:10:21

0:18:47

0:18:47

0:26:08

0:26:08

0:08:03

0:08:03

0:26:43

0:26:43

0:05:49

0:05:49

0:03:48

0:03:48

0:05:50

0:05:50

0:09:09

0:09:09

0:07:49

0:07:49

0:24:39

0:24:39