filmov

tv

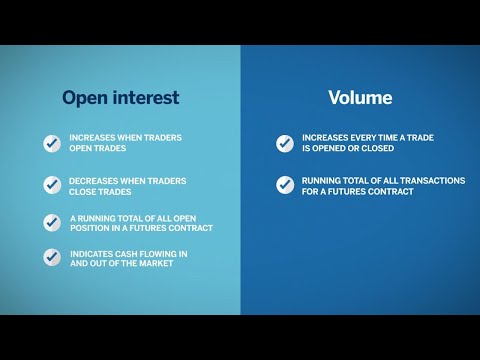

Interpretations of Open Interest

Показать описание

Today's video covers various interpretations of open interest and ways in which you can use it simply to achieve high probability results. The platform I am using for analysis is TRDR.io. Additionally, in the future, I will be solely posting on Friday instead of doing videos every Tuesday and Friday. Happy trading.

Get access to the TRDR course here

_________________________________________________________________________________________________

Disclaimer: The content covered in this video is NOT investment advice and I am not a financial advisor. The material covered within these videos is for educational purposes only. Always do your own research and only invest based on your own findings and personal judgment. Happy Trading!

Get access to the TRDR course here

_________________________________________________________________________________________________

Disclaimer: The content covered in this video is NOT investment advice and I am not a financial advisor. The material covered within these videos is for educational purposes only. Always do your own research and only invest based on your own findings and personal judgment. Happy Trading!

Interpretations of Open Interest

A Different Take on OPEN INTEREST Analysis!

Understand Open Interest if you want to survive in the options market

🔍 What is Open Interest and Why is it Important When Trading Options

What is Open Interest (OI)? And how to Interpret it? | Trade Brains

4 simple rules to interpret Open Interest!💰

What is Open Interest? | CA Rachana Ranade | #shorts

What is OI and how to read it? | How to trade Options E9

Advanced Option Chain Analysis Explained | Open Interest, IV, Short Covering, Long Unwinding

Options Open Interest Analysis with SpotGamma

Open Interest: A Simple Explanation & Open Interest Analysis & Trading Strategy

Open Interest VS Change In Open interest | Option Chain Analysis

option trading | Open interest vs change in open interest #optionstrading #stockmarket #shorts

Open Interest OI Analysis Part 1: Basics | Make Profit Using OI Data | Sensibull | Optionables

VOLUME & OPEN INTEREST in Options | Mission Options E23

The only 'OPTION CHAIN Analysis' video you will ever need | Open Interest Analysis & I...

Open Interest

Open Interest ANALYSIS - Beyond Support and Resistance -Nifty Option Trading

Open Interest Trading Strategy | Option Chain Analysis | Option Trading Tamil

VOLUME AND OPEN INTEREST - * They are not the Same *

Technical Analysis - Futures Open Interest and Commitments of Traders Data | May 23/2023.

Open Interest Explained for Traders | OI Analysis in Stock Market

Stock Selection Using FII Open Interest Analysis - July 1st Week 2022 | EQSIS

Open Interest Data Analysis || OI Data || OI Change || Explained | Angel One

Комментарии

0:12:03

0:12:03

0:08:35

0:08:35

0:00:58

0:00:58

0:07:04

0:07:04

0:10:33

0:10:33

0:00:42

0:00:42

0:01:00

0:01:00

0:17:16

0:17:16

0:29:23

0:29:23

0:00:53

0:00:53

0:16:59

0:16:59

0:00:49

0:00:49

0:01:01

0:01:01

0:26:34

0:26:34

0:12:50

0:12:50

0:27:03

0:27:03

0:03:25

0:03:25

0:08:07

0:08:07

0:00:52

0:00:52

0:00:56

0:00:56

0:58:28

0:58:28

0:07:20

0:07:20

0:08:38

0:08:38

0:07:34

0:07:34