filmov

tv

Determining Allowance for Sampling Risk [CPA Prep]

Показать описание

Unlock a holistic learning experience tailored to help you pass the CPA exams. Gain access to interactive quizzes, practice exams, and task-based simulations that mirror the real exam experience. Our AI-driven platform adapts to your learning style, providing personalized pathways to master each section of the CPA exam.

🎓 Lesson Overview:

In this lesson, Nick Palazzolo explains the concept of allowance for sampling risk, which is the maximum amount of error acceptable when using a sample to make generalizations about a population. The lesson provides an example where an auditor validates the authorization for 15,000 sales invoices, with a sample of 300 invoices analyzed. By calculating the difference between the upper deviation rate (given in the example) and the sample deviation rate (based on the sample problems), Nick illustrates how to determine the allowance for sampling risk. This concept is essential for auditors when determining the accuracy of their audit testing on transactions and account balances.

🔍 Key Topics Covered:

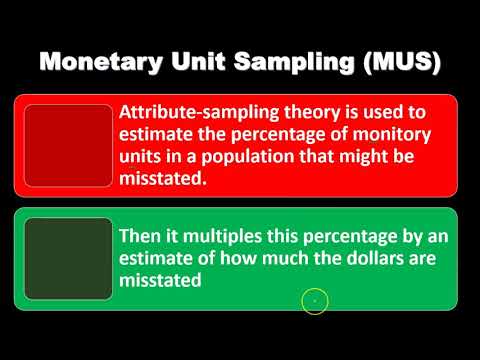

- Sampling Techniques

- Allowance for Sampling Risk

- Audit Sampling

- Auditor Techniques

💡 Learn More and Elevate Your CPA Exam Preparation:

Our comprehensive course offers a unique blend of AI-driven personalized learning experiences, expert insights, and practical exercises designed to ensure you're fully prepared to conquer the CPA exams.

👉 Begin your journey to becoming a Certified Public Accountant today!

#CPAExam #Accounting #ExamPrepAI

0:04:44

0:04:44

0:18:32

0:18:32

0:23:44

0:23:44

0:12:48

0:12:48

0:02:12

0:02:12

0:23:57

0:23:57

0:19:43

0:19:43

0:24:28

0:24:28

0:27:08

0:27:08

0:03:22

0:03:22

0:12:55

0:12:55

0:04:55

0:04:55

1:51:44

1:51:44

0:18:51

0:18:51

0:11:17

0:11:17

0:49:45

0:49:45

0:18:26

0:18:26

0:18:05

0:18:05

0:15:18

0:15:18

2:05:26

2:05:26

0:28:20

0:28:20

0:02:24

0:02:24

1:49:27

1:49:27

0:08:30

0:08:30