filmov

tv

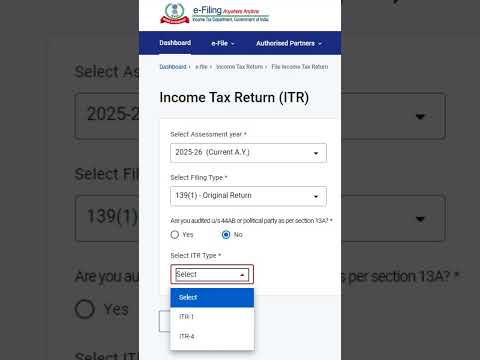

How to file Belated Income Tax Return AY 23-24#Chance to file return after 31st July

Показать описание

If you have missed the Due date for Income Tax Return filing for the AY 23-24 and FY 22-23. Then do not worry still you have chance to file your Income Tax Return by filing late fees u/s 234F upto 31st Dec'2023.

Your penalty amount will be-

Income below Basic Exemption Limit (Rs. 2.5 Lakh for AY 23-24) - NIL

Income Below Rs. 5 Lakh- Rs. 1000

Income Above Rs. 5 Lakh - Rs. 5000

belated income tax return

belated income tax return for ay 2021 22

income tax return

what is belated income tax return

how to file income tax return after due date

income tax

belated itr

itr

how to file last year income tax return after due date

income tax return filing 2022-23

income tax return filing

income tax returns

belated return

late filing of income tax return

how to file income tax return

how to file itr after due date

itr filing

how to file itr after due date is over

itr filing after due date

income tax return u/s 139(4) of income tax act

section 139(4) of the income tax act - belated return

section 139(4) of income tax act

income tax return after due date

income tax return filing after due date

what is belated return

late filing of itr

after due date how to file income tax return

late fee u/s 234f

how to file itr without late fees

tax return

itr last date

itr late filing

itr last date 2022 23 extended

how to file revised return

Your penalty amount will be-

Income below Basic Exemption Limit (Rs. 2.5 Lakh for AY 23-24) - NIL

Income Below Rs. 5 Lakh- Rs. 1000

Income Above Rs. 5 Lakh - Rs. 5000

belated income tax return

belated income tax return for ay 2021 22

income tax return

what is belated income tax return

how to file income tax return after due date

income tax

belated itr

itr

how to file last year income tax return after due date

income tax return filing 2022-23

income tax return filing

income tax returns

belated return

late filing of income tax return

how to file income tax return

how to file itr after due date

itr filing

how to file itr after due date is over

itr filing after due date

income tax return u/s 139(4) of income tax act

section 139(4) of the income tax act - belated return

section 139(4) of income tax act

income tax return after due date

income tax return filing after due date

what is belated return

late filing of itr

after due date how to file income tax return

late fee u/s 234f

how to file itr without late fees

tax return

itr last date

itr late filing

itr last date 2022 23 extended

how to file revised return

0:07:01

0:07:01

0:08:36

0:08:36

0:03:02

0:03:02

0:04:50

0:04:50

0:07:28

0:07:28

0:01:00

0:01:00

0:04:19

0:04:19

0:16:46

0:16:46

0:00:28

0:00:28

0:07:48

0:07:48

0:08:10

0:08:10

0:05:36

0:05:36

0:01:50

0:01:50

0:00:16

0:00:16

0:00:16

0:00:16

0:00:10

0:00:10

0:00:11

0:00:11

0:16:52

0:16:52

0:05:41

0:05:41

0:00:45

0:00:45

0:01:01

0:01:01

0:00:57

0:00:57

0:00:24

0:00:24

0:00:58

0:00:58