filmov

tv

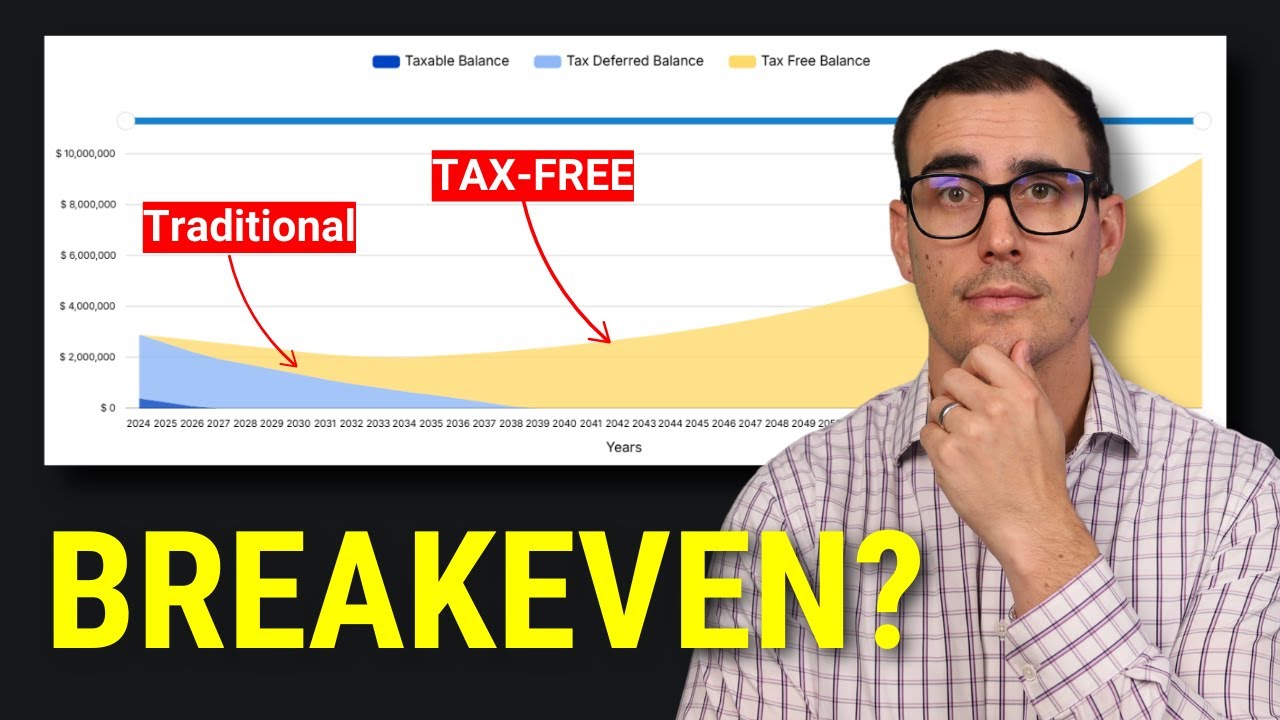

How Long Until Your Roth Conversion Actually Pays Off in Retirement?

Показать описание

WORK WITH ME👇🏼

✅ See how we can help you get more out of early retirement

In the video, I explain when the best time to take a Roth conversion and other factors to look for before you decide how much to convert.

⚠️ "DISCLAIMER:⚠️

All content is not to be received as financial advice and each individual should consult with their dedicated financial planner, tax preparer, estate attorney, etc. before making any financial decisions.

All contents provided by This Channel is meant for EDUCATIONAL AND ENTERTAINMENT PURPOSE only.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you.

⚠️ "Scammer" Warning ➡ PLEASE READ! ⚠️ Be careful of scammers. In the comments section, I will NEVER ask you to contact me, offer any investment products, recommend a stock broker, or anything similar. Some scam bot commenters 'ask' for investment help, and later, other comment bots reply with "how great X idea/investment/person is" in the replies. These are scam threads. Do not fall for them

0:00 - Introduction

1:21 - Why even Consider a Roth Conversion?

3:26 - The Wrong way to view Roth Conversions

8:05 - When Can a Roth Conversion Payoff Sooner

10:00 - The Right way to view Roth Conversions

10:55 - Outro

✅ See how we can help you get more out of early retirement

In the video, I explain when the best time to take a Roth conversion and other factors to look for before you decide how much to convert.

⚠️ "DISCLAIMER:⚠️

All content is not to be received as financial advice and each individual should consult with their dedicated financial planner, tax preparer, estate attorney, etc. before making any financial decisions.

All contents provided by This Channel is meant for EDUCATIONAL AND ENTERTAINMENT PURPOSE only.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you.

⚠️ "Scammer" Warning ➡ PLEASE READ! ⚠️ Be careful of scammers. In the comments section, I will NEVER ask you to contact me, offer any investment products, recommend a stock broker, or anything similar. Some scam bot commenters 'ask' for investment help, and later, other comment bots reply with "how great X idea/investment/person is" in the replies. These are scam threads. Do not fall for them

0:00 - Introduction

1:21 - Why even Consider a Roth Conversion?

3:26 - The Wrong way to view Roth Conversions

8:05 - When Can a Roth Conversion Payoff Sooner

10:00 - The Right way to view Roth Conversions

10:55 - Outro

Комментарии

0:09:40

0:09:40

0:11:27

0:11:27

0:03:28

0:03:28

0:11:44

0:11:44

0:00:41

0:00:41

0:05:15

0:05:15

0:11:47

0:11:47

0:09:49

0:09:49

0:00:16

0:00:16

0:04:40

0:04:40

0:14:50

0:14:50

0:10:36

0:10:36

0:04:46

0:04:46

0:21:20

0:21:20

0:08:40

0:08:40

0:05:35

0:05:35

0:03:36

0:03:36

0:10:49

0:10:49

0:00:51

0:00:51

0:11:38

0:11:38

0:12:20

0:12:20

0:06:06

0:06:06

0:10:11

0:10:11

0:15:36

0:15:36