filmov

tv

Oracle FA Amortized Vs Expensed Adjustment

Показать описание

Oracle FA Amortized Vs Expensed Adjustment

Amortization Intangible Asset | Financial Consolidation Amortization | Oracle FCCS | FCCS Basics

Financial Consolidation Amortization of Intangible Assets | Oracle FCCs Intangible Asset | IAS38

Capitalize vs Expense: Basic Accounting

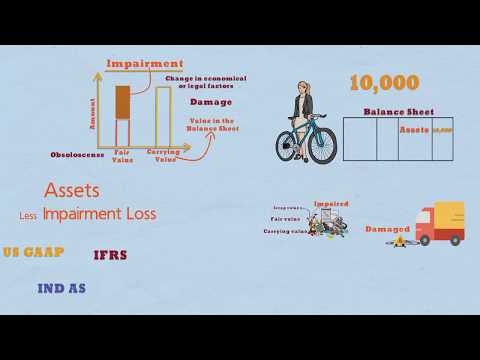

Impairment of Fixed Assets – What is Impairment?

Can we Retire Expense Assets and CIP Assets at any time?

How to Amortize Intangible Assets

Oracle Expense Amortization Overview | NetSuite Fixed Asset Configuration | NetSuite Consultants

Oracle Fusion Tutorial for beginners | Fixed Assets Fusion: How To change Asset Financial Details

Live Webinar of Oracle EBS R12 Fixed Asset #10 | Oracle EBS Basics |Oracle Fixed Assets Process Flow

Oracle FA Physical Inventory Process

Oracle EBS Asset Adjustments

How to Change Life Years Field for an Asset in Oracle EBS R12 or R11 Using API?

Oracle Fusion Fixed Asset (FA)| Fixed Asset Key Flexfield |Prorate Convention in Fixed Assets

Oracle EBS R12 Fixed Asset Tutorial |Oracle Fixed Assets User Guide |Overview Fixed Asset Life Cycle

Oracle Fusion | FA Cost Adjustment | CA SUHAS VAZE | OracleErpGuide.com

NetSuite Tutorial - Expense Amortization

Day4 Part10 Oracle Training Fixed Asset Module

FA Lesson 01: Introduction To The Oracle Fixed Asset (FA) Module

#118 | How to Create an Amortization Expense Vendor Bill & GL Impact in NetSuite

Oracle Fixed Asset Reclassification | Oracle Asset Reclassification | Oracle Fusion Asset Life Cycle

How to Change Category for an Asset in Oracle EBS R12 or R11 Using API?

ORACLE FA ADDITION depreciation JE

NetSuite Tutorial - Advanced Expense Management (AEM)

Комментарии

0:13:35

0:13:35

0:10:43

0:10:43

0:16:17

0:16:17

0:04:31

0:04:31

0:02:04

0:02:04

0:00:48

0:00:48

0:01:58

0:01:58

0:07:27

0:07:27

0:01:20

0:01:20

1:20:50

1:20:50

0:12:27

0:12:27

0:07:24

0:07:24

0:04:50

0:04:50

1:01:26

1:01:26

0:33:29

0:33:29

0:15:11

0:15:11

0:10:24

0:10:24

0:00:42

0:00:42

0:28:04

0:28:04

0:02:00

0:02:00

0:03:17

0:03:17

0:06:10

0:06:10

0:32:52

0:32:52

0:13:17

0:13:17