filmov

tv

What is a Derivatives Clearing House? What do they do?

Показать описание

What is a Derivatives Clearing House? What do they do?

After legally-binding trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the settlement of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties.

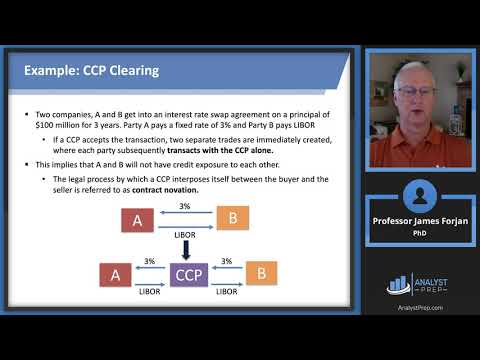

In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perform the obligations under the contract agreed between the two counterparties, thereby removing the counterparty risk the parties of the contract had to each other and replacing it with counterparty risk to a highly regulated central counterparty that specializes in managing and mitigating counterparty risk.

After legally-binding trade between a buyer and a seller, the role of the clearing house is to centralize and standardize all of the steps leading up to the settlement of the transaction. The purpose is to reduce the cost, settlement risk and operational risk of clearing and settling multiple transactions among multiple parties.

In addition to the above services, central counterparty clearing (CCP) takes on counterparty risk by stepping in between the original buyer and seller of a financial contract, such as a derivative. The role of the CCP is to perform the obligations under the contract agreed between the two counterparties, thereby removing the counterparty risk the parties of the contract had to each other and replacing it with counterparty risk to a highly regulated central counterparty that specializes in managing and mitigating counterparty risk.

What is a Derivatives Clearing House? What do they do?

Derivatives Explained in One Minute

7. Clearing and settlement process

What is a clearing house?

FinTech Minute: Cleared Derivatives with Andrew Whyte

What is a clearing house? - MoneyWeek Investment Tutorials

EU agrees new rules to move euro derivatives clearing from London

What Is Clearing?

AGNIVEER AIRFORCE ICG || Mathematics Application of Derivatives Practice Class 2 || by Prashant Sir

Over-The-Counter (OTC) Trading and Broker-Dealers Explained in One Minute: OTC Link, OTCBB, etc.

Futures and central clearing

Bilateral Initial Margin for Non-Cleared OTC Derivatives

Market Matters | FICC Market Structure: Breaking Down Derivatives Clearing Trends

What is the role of Clearing Corporations in Trading and Settlement? | Motilal Oswal

Derivatives Clearing System: CSCS, NSE Target Jan. 2017

Regulation of OTC Derivatives Market (FRM Part 2 2023 – Book 3 – Chapter 18)

OTC Derivatives

Exchange v OTC derivatives

Derivatives Clearing System: Kyari Says CCP Will Enhance FX Market Features

OTC derivatives: euro exposures rise and central clearing advances

Clearing House Account Definitions

ASX Clear (Futures) explained

Futures Market Explained

OTC Derivatives under Central Clearing

Комментарии

0:04:41

0:04:41

0:01:30

0:01:30

0:04:57

0:04:57

0:02:33

0:02:33

0:01:35

0:01:35

0:12:21

0:12:21

0:01:45

0:01:45

0:02:05

0:02:05

0:45:15

0:45:15

0:01:47

0:01:47

0:08:10

0:08:10

0:01:51

0:01:51

0:10:26

0:10:26

0:04:04

0:04:04

0:01:29

0:01:29

0:21:54

0:21:54

0:17:35

0:17:35

0:05:55

0:05:55

0:01:31

0:01:31

0:02:28

0:02:28

0:02:56

0:02:56

0:03:08

0:03:08

0:04:27

0:04:27

0:10:19

0:10:19