filmov

tv

IAS 16 Property, Plant and Equipment: Summary - applies in 2024

Показать описание

Visit our website for great discussion with many practical advices on this standard.

This is just the short executive summary of IAS 16 and does NOT replace the full standard - you can see the full text on IFRS Foundation's website.

------

#IFRS #IAS16 #ifrsaccounting

This is just the short executive summary of IAS 16 and does NOT replace the full standard - you can see the full text on IFRS Foundation's website.

------

#IFRS #IAS16 #ifrsaccounting

IAS 16 Property, Plant and Equipment: Summary - applies in 2024

IAS 16 Property, plant and equipment – Initial Recognition - CIMA F1 Financial Reporting

IAS 16 - PROPERTY, PLANT AND EQUIPMENT (PART 1)

The fundamentals of IAS 16

Property, Plant, and Equipment: Overview of IAS 16

IAS 16 PPE | Property, Plant & Equipment | Revaluation Model | Commerce Specialist |

THE PPE SCHEDULE (IAS 16)

IAS 16 - PROPERTY, PLANT AND EQUIPMENT (PART 2)

Property, Plant and Equipment - IAS 16 (Part 1)

IAS 16 PROPERTY, PLANT AND EQUIPMENT. ( PART 1 ). PPE . ACCOUNTANCY TUTORIALS

IAS 16 Property, Plant and Equipment - ACCA Financial Accounting (FA) lectures

Determine useful Life of an Asset | IAS-16 | Property, Plant & Equipment | Accounting Standards

Property Plant and Equipment Schedule (PPE Note) FULL EXAMPLE

ACCA I Strategic Business Reporting (SBR) I IAS 16 - Property, Plant & Equipment - SBR Lecture 9

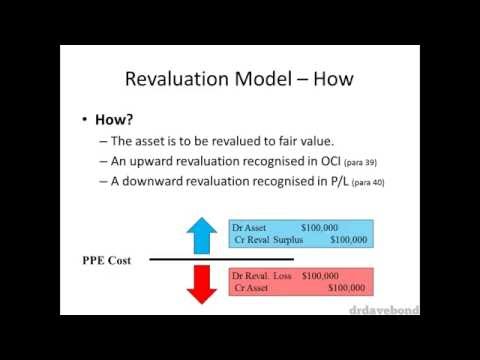

Accounting for Revaluations of PPE

FA/FR: IAS 16 Property, Plant & Equipment || Part 1

IAS 16 PROPERTY PLANT AND EQUIPTMENT

Introduction to IAS 16 Property Plant & Equipment: ACCA Financial Reporting (FR) | Concept Cover...

IAS 16-Property Plant and Equipment-ACCA SBR(in Depth) by Rohit Singhal

IAS 16 Property, Plant and Equipment | Component Approach

IAS 16 Property, Plant and equipment

ACCA F3 IAS 16 Property, Plant and Equipment

FA/FR: IAS 16 Property, Plant & Equipment || Part 2

More common errors when accounting for property, plant and equipment (IAS 16 – Part 2)

Комментарии

0:10:47

0:10:47

0:18:24

0:18:24

0:42:27

0:42:27

0:02:26

0:02:26

0:01:07

0:01:07

0:21:23

0:21:23

0:13:42

0:13:42

0:31:54

0:31:54

0:42:12

0:42:12

0:42:24

0:42:24

0:04:34

0:04:34

0:02:56

0:02:56

0:27:59

0:27:59

1:23:18

1:23:18

0:07:57

0:07:57

0:54:32

0:54:32

3:52:19

3:52:19

0:13:17

0:13:17

1:21:09

1:21:09

0:02:37

0:02:37

1:32:42

1:32:42

0:04:31

0:04:31

1:06:15

1:06:15

0:01:34

0:01:34