filmov

tv

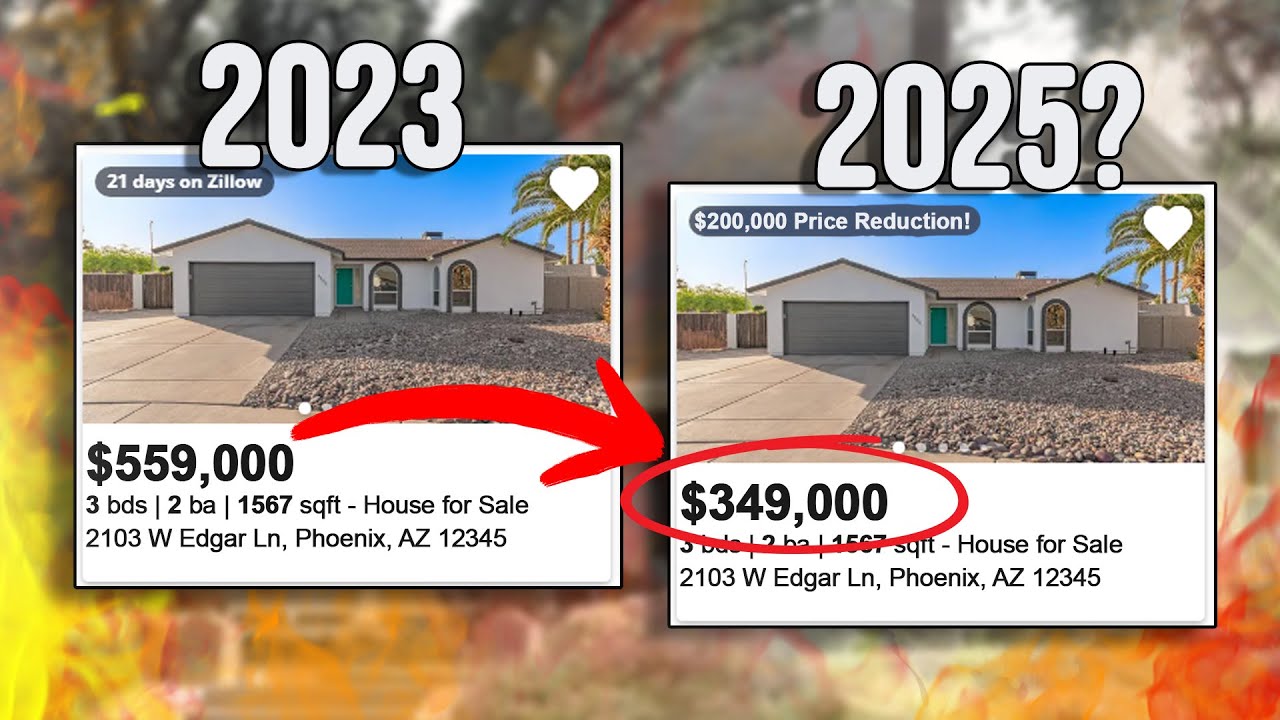

What Happens If The Market Crashes AFTER You Buy A House?

Показать описание

🌵 Work With Javy in Phoenix, AZ

🪙 Resources I Have Gathered For You

🤙 Join The Community

#realestate #firsttimehomebuyer #javiervidana

The Stock Market Crash of 2024 Is Starting

'Worse Than a Stock Market Crash' - What Would Happen if the Fed Cuts Interest Rates?

History Shows It's Time to GET OUT When this Happens… (90 Days Left)

What Happens If The Market Crashes AFTER You Buy A House?

What the Heck Happens After Market Close?

WHAT HAPPENS TO #BITCOIN WHEN STOCK MARKET CRASHES?!?

What Happens To The Real Estate Market When All The Boomers... Die?

How Stock Market Crashes Happen

Stock market analysis 8-2-24. trade ideas and setups

What Happens if the Market CRASHES?! | Samuel Leeds

When A Stock Market Crash Will Happen (REAL Truth)

What happens to bonds when stock market crashes?

Must See - What Happens When It's A Bear Market? | A Study Of S&P 500 In Previous Market Cr...

Unbelievable! THIS Could Happen if the Market Crashes...

Interest Rate Cuts in September by The Fed: Be Prepared!

What Happens If The Market Crashes Right When I First Retire?

Housing Market FLASH CRASH MAP 2024

Explained: What Will Happen To ETFs If The Market Crashes?

What happens if the Stock Market crashes during retirement?

What happens to my Roth IRA if the stock market crashes?

What Happens to Bitcoin if Stock Markets Crash into a Bear Market?

What Will Happen to Gold If Stock Market Crashes? Investing in Gold

Crypto Market Predictions For 2024 / What Will Happen To Bitcoin And Crypto The Rest Of This Year

The 2024 Stock Market CRASH Just Started

Комментарии

0:15:26

0:15:26

0:21:22

0:21:22

0:06:51

0:06:51

0:18:18

0:18:18

0:09:26

0:09:26

0:06:35

0:06:35

0:12:15

0:12:15

0:08:51

0:08:51

0:09:47

0:09:47

0:02:09

0:02:09

0:09:45

0:09:45

0:00:58

0:00:58

0:10:50

0:10:50

0:01:00

0:01:00

0:11:11

0:11:11

0:06:25

0:06:25

0:45:38

0:45:38

0:05:38

0:05:38

0:03:31

0:03:31

0:00:46

0:00:46

0:08:21

0:08:21

0:04:07

0:04:07

0:18:27

0:18:27

0:16:44

0:16:44