filmov

tv

Where the Ultra-Rich Are Investing Their Money

Показать описание

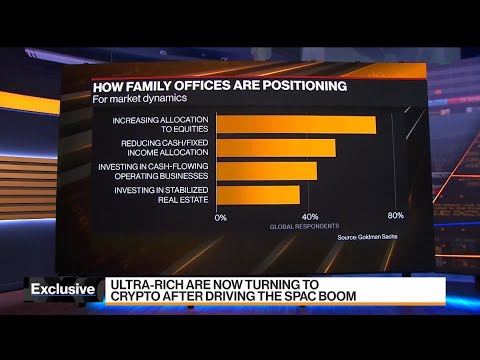

Jul.21 -- Meena Flynn, global co-head of private wealth at Goldman Sachs, discusses results of her firm’s recent survey of managers of the wealth and personal affairs of the ultra-rich and interest in cryptocurrency by family offices. She speaks on "Bloomberg Markets: European Close."

Where the Ultra-Rich Are Investing Their Money

Here's how the ultra-rich invest

Here's How The Rich Invest Their Money

This is how the ultra-rich are investing their money

Where Do the Ultra-Rich Invest Their Money?

Warren Buffett Brilliantly Explains Levels Of Wealth

Here's How The Rich Invest Their Money - High Net Worth Wealth Management

How the Ultra-Rich Invest Their Wealth To Be Rich Forever! | Eye Opening Interview with @AbhishekKar

Smart Money Explained!!: The secret behind Wealthy Investors 💸💸??

Where the ultra-rich invest during a volatile market

How the Elite HIDE THEIR MONEY & pass down Generational Wealth

Elon Musk Brilliantly explains Wealth & how to be a billionaire!

Buy, Borrow, Die: How America's Ultrawealthy Stay That Way

15 Investments Rich People Make The Poor Know Nothing About

Why is Switzerland home to so many billionaires?

Luxury was created to keep you poor!

Here's How The Rich Invest Their Money

I Asked Wall Street Millionaires For Investing Advice

I Asked a Billionaire If It Was Worth It

The Ultra Rich Playbook [Legal & Tax-Free]

Daily Habits of the Ultra Rich: #88

Real Estate Investing is Not Only for the Ultra Wealthy

The Secret Between Rich Vs Wealthy 🤫

Inside a Super Rich Gated Community (Extreme Wealth Documentary) | Real Stories

Комментарии

0:06:11

0:06:11

0:04:43

0:04:43

0:11:56

0:11:56

0:03:49

0:03:49

0:03:05

0:03:05

0:03:59

0:03:59

0:15:16

0:15:16

1:26:33

1:26:33

0:00:59

0:00:59

0:03:26

0:03:26

0:20:43

0:20:43

0:00:53

0:00:53

0:01:53

0:01:53

0:24:28

0:24:28

0:07:24

0:07:24

0:00:42

0:00:42

0:16:53

0:16:53

0:08:02

0:08:02

0:00:33

0:00:33

0:27:24

0:27:24

0:00:31

0:00:31

0:00:56

0:00:56

0:00:34

0:00:34

0:53:29

0:53:29