filmov

tv

Understanding Retained Earnings in QuickBooks

Показать описание

Have you pulled your Balance Sheet and you are wondering where the “Retained Earnings” amount is coming from?

Let’s talk a little about what you’re seeing on your reports… 😊

Learn where retained earnings come from and why they are on the balance sheet.

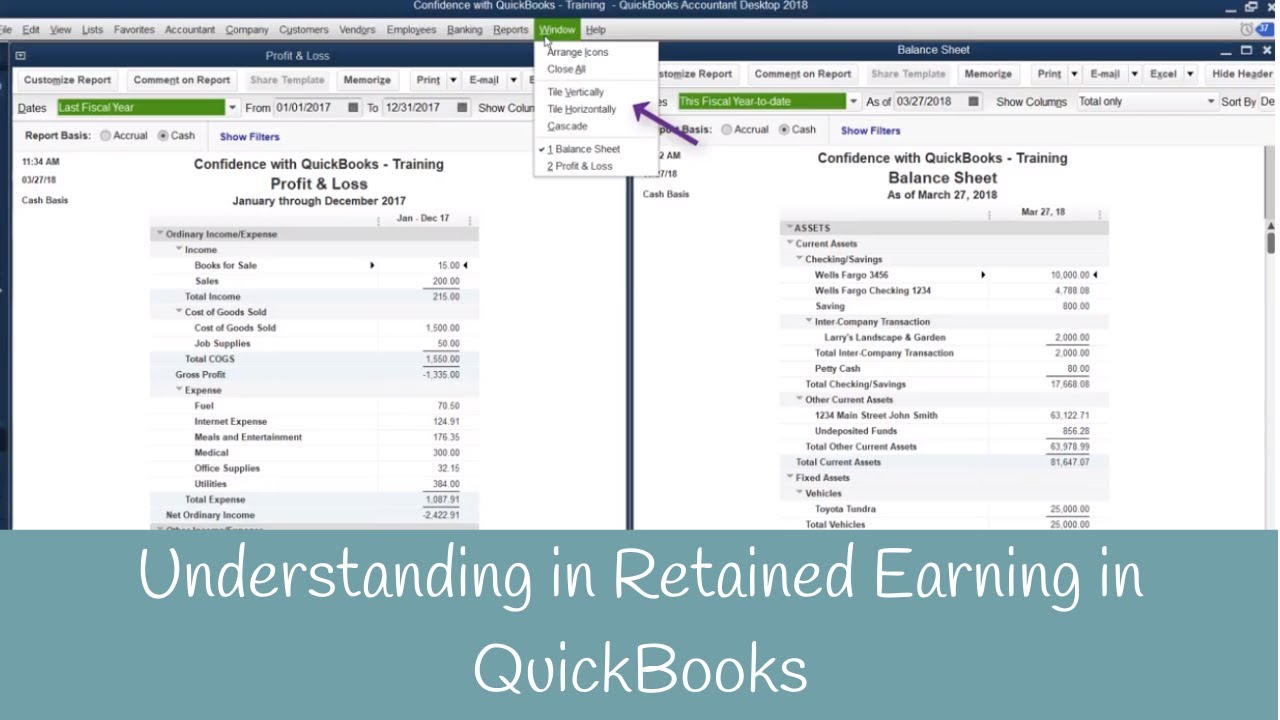

➡️ Making reports Side by Side

Go up to Window

“Tile Vertically”/ “Tile Horizontally”

Cash Basis – At the moment you spend money it’s an expense, and at the moment you get paid from customers it’s Income.

Accrual Basis – At the moment you bill customers it’s Income, and at the moment you get the bill, it’s expense.

➡️ Profit & Loss

Has your Income, Expenses, Net Income.

➡️ Balance Sheet

Has your Assets, Liabilities, Equity.

➡️ Opening Balance

The account QuickBooks creates – a generalized account.

➡️ Retained Earnings

Profit you’ve made in the previous years.

➡️ Net Income

Current Year Profit

Timestamps:

0:00 - Intro

0:21 - Checking reports side by side

1:05 - Cash vs accrual basis

1:30 - Proft & Loss

1:41 - Balance Sheet

2:27 - Equity

3:06 - What is opening balance?

3:44 - Retained Earnings

4:27 - Net Income

5:01 - Negative in equity explained

5:50 - Why is retained earnings negative?

6:24 - Double-entry accounting

7:06 - Final Thoughts

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe here for more QuickBooks tips

I’d love to connect with you 👇

#CandusKampfer

Let’s talk a little about what you’re seeing on your reports… 😊

Learn where retained earnings come from and why they are on the balance sheet.

➡️ Making reports Side by Side

Go up to Window

“Tile Vertically”/ “Tile Horizontally”

Cash Basis – At the moment you spend money it’s an expense, and at the moment you get paid from customers it’s Income.

Accrual Basis – At the moment you bill customers it’s Income, and at the moment you get the bill, it’s expense.

➡️ Profit & Loss

Has your Income, Expenses, Net Income.

➡️ Balance Sheet

Has your Assets, Liabilities, Equity.

➡️ Opening Balance

The account QuickBooks creates – a generalized account.

➡️ Retained Earnings

Profit you’ve made in the previous years.

➡️ Net Income

Current Year Profit

Timestamps:

0:00 - Intro

0:21 - Checking reports side by side

1:05 - Cash vs accrual basis

1:30 - Proft & Loss

1:41 - Balance Sheet

2:27 - Equity

3:06 - What is opening balance?

3:44 - Retained Earnings

4:27 - Net Income

5:01 - Negative in equity explained

5:50 - Why is retained earnings negative?

6:24 - Double-entry accounting

7:06 - Final Thoughts

Need to learn more areas of QuickBooks? Join us on our next workshop to learn how to design QuickBooks for your specific business...

Receive our QB tips straight to your inbox each week visit:

Subscribe here for more QuickBooks tips

I’d love to connect with you 👇

#CandusKampfer

Комментарии

0:08:33

0:08:33

0:04:46

0:04:46

0:02:30

0:02:30

0:09:17

0:09:17

0:00:22

0:00:22

0:07:56

0:07:56

0:01:01

0:01:01

0:02:52

0:02:52

0:13:53

0:13:53

0:03:02

0:03:02

0:01:06

0:01:06

0:04:36

0:04:36

0:07:43

0:07:43

0:04:15

0:04:15

0:00:50

0:00:50

0:14:05

0:14:05

0:07:00

0:07:00

0:18:18

0:18:18

0:13:01

0:13:01

0:05:09

0:05:09

0:08:44

0:08:44

0:04:25

0:04:25

0:07:26

0:07:26

0:28:58

0:28:58