filmov

tv

The Difference between Auditors and Forensic Accountants | Uncover Fraud

Показать описание

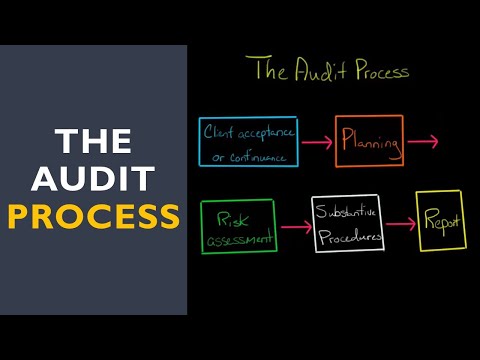

You think an auditor and a forensic accountant are the same? Let me tell you that they are not. You might think you are safe because you have had an auditor come and look at your books once a year, but an audit is not looking at data in the same way as a forensic accountant.

In this video I am going explain the differences between auditors and forensic accountants. Explain the similarities between the two roles. Explain why CPAs in forensics are at risk and how compare the auditor and forensic accountant’s objectives, responsibilities, professional standards, and engagement terms.

Other Notable Differences

• Timing – Audits are planned periodically and on a recurring basis. Forensic

investigations are unforeseen, reactive and nonrecurring.

• Predication – A forensic investigation begins with an allegation or suspicion of fraud. The allegation or suspicion of fraud is not the basis of an audit.

• Obligation – Forensic investigations are typically conducted voluntarily

because a company has a suspicion or allegation of fraud. An audit is an

obligated engagement for which a company must hire an auditor to provide

an opinion on the truthfulness and fairness of its financial statements.

• Performance – An audit is performed by auditors who are CPAs. A forensic

investigation is typically performed by a multidiscipline team of experts that

often includes CPAs.

• Appointment – The appointment of an auditor is made by the shareholders of the company. A forensic accountant is appointed by the owners/ management, counsel or a third party.

About me: My name is David Malamed. I am an experienced forensic accountant and fraud investigator that has investigated, reported, testified and authored expert Forensic Accounting and Investigative reports accepted and used in civil, criminal and public inquiry proceedings.

Contact me at:

Call: 1(888) 777-4416

#fraudster #forensicaccountant #fraud

In this video I am going explain the differences between auditors and forensic accountants. Explain the similarities between the two roles. Explain why CPAs in forensics are at risk and how compare the auditor and forensic accountant’s objectives, responsibilities, professional standards, and engagement terms.

Other Notable Differences

• Timing – Audits are planned periodically and on a recurring basis. Forensic

investigations are unforeseen, reactive and nonrecurring.

• Predication – A forensic investigation begins with an allegation or suspicion of fraud. The allegation or suspicion of fraud is not the basis of an audit.

• Obligation – Forensic investigations are typically conducted voluntarily

because a company has a suspicion or allegation of fraud. An audit is an

obligated engagement for which a company must hire an auditor to provide

an opinion on the truthfulness and fairness of its financial statements.

• Performance – An audit is performed by auditors who are CPAs. A forensic

investigation is typically performed by a multidiscipline team of experts that

often includes CPAs.

• Appointment – The appointment of an auditor is made by the shareholders of the company. A forensic accountant is appointed by the owners/ management, counsel or a third party.

About me: My name is David Malamed. I am an experienced forensic accountant and fraud investigator that has investigated, reported, testified and authored expert Forensic Accounting and Investigative reports accepted and used in civil, criminal and public inquiry proceedings.

Contact me at:

Call: 1(888) 777-4416

#fraudster #forensicaccountant #fraud

Комментарии

0:11:53

0:11:53

0:09:58

0:09:58

0:05:42

0:05:42

0:06:02

0:06:02

0:13:41

0:13:41

0:09:47

0:09:47

0:05:10

0:05:10

0:01:25

0:01:25

0:04:33

0:04:33

0:13:14

0:13:14

0:14:18

0:14:18

0:06:42

0:06:42

0:26:21

0:26:21

0:01:52

0:01:52

0:07:55

0:07:55

0:08:43

0:08:43

0:10:09

0:10:09

0:08:45

0:08:45

0:10:41

0:10:41

0:11:43

0:11:43

0:13:11

0:13:11

0:26:21

0:26:21

0:07:24

0:07:24

0:51:48

0:51:48