filmov

tv

David Bellhouse - The Emergence of Actuarial Science in the 18th Century

Показать описание

David Bellhouse, Western University

November 5, 2018

Rutgers, Foundations of Probability

Title: The Emergence of Actuarial Science in the 18th Century

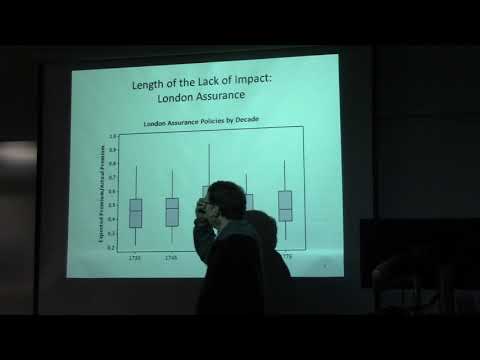

In 1987, historian of science Lorraine Daston wrote about the impact of mathematics on the nascent insurance industry in England.

"Despite the efforts of mathematicians to apply probability theory and mortality statistics to problems in insurance and annuities in the late seventeenth and early eighteenth centuries, the influence of this mathematical literature on the voluminous trade in annuities and insurance was negligible until the end of the eighteenth century."

This view is a standard one in the history of insurance today. There is, however, a small conundrum attached to this view. Throughout the eighteenth century, several mathematicians were writing books about life annuities, often long ones containing tables requiring many hours of calculation. The natural question is: who were they writing for and why? Themselves? For the pure academic joy of the exercise? The answer that I will put forward is that mathematicians were not writing for the insurance industry, but about something else – life contingent contracts related to property. These included valuing leases whose terms were based on the lives of three people, marriage settlements and reversions on estates. As in many other situations, it took a crisis to change the insurance industry. This happened in the 1770s when many newly-founded companies offered pension-type products that were grossly underfunded. This was pointed out at length in layman’s terms by Richard Price, the first Bayesian. The crisis reached the floor of the House of Commons before the mathematicians won the day.

November 5, 2018

Rutgers, Foundations of Probability

Title: The Emergence of Actuarial Science in the 18th Century

In 1987, historian of science Lorraine Daston wrote about the impact of mathematics on the nascent insurance industry in England.

"Despite the efforts of mathematicians to apply probability theory and mortality statistics to problems in insurance and annuities in the late seventeenth and early eighteenth centuries, the influence of this mathematical literature on the voluminous trade in annuities and insurance was negligible until the end of the eighteenth century."

This view is a standard one in the history of insurance today. There is, however, a small conundrum attached to this view. Throughout the eighteenth century, several mathematicians were writing books about life annuities, often long ones containing tables requiring many hours of calculation. The natural question is: who were they writing for and why? Themselves? For the pure academic joy of the exercise? The answer that I will put forward is that mathematicians were not writing for the insurance industry, but about something else – life contingent contracts related to property. These included valuing leases whose terms were based on the lives of three people, marriage settlements and reversions on estates. As in many other situations, it took a crisis to change the insurance industry. This happened in the 1770s when many newly-founded companies offered pension-type products that were grossly underfunded. This was pointed out at length in layman’s terms by Richard Price, the first Bayesian. The crisis reached the floor of the House of Commons before the mathematicians won the day.

1:21:01

1:21:01

0:00:16

0:00:16

0:00:33

0:00:33

0:09:43

0:09:43

0:55:08

0:55:08

0:12:30

0:12:30

1:42:51

1:42:51

0:07:32

0:07:32

0:03:29

0:03:29

0:01:20

0:01:20

0:50:03

0:50:03

0:49:57

0:49:57

0:13:42

0:13:42

0:57:55

0:57:55

0:05:09

0:05:09

0:46:41

0:46:41

0:25:49

0:25:49

0:05:14

0:05:14

0:18:25

0:18:25

0:03:06

0:03:06

1:55:45

1:55:45

0:48:36

0:48:36

0:04:38

0:04:38

0:05:36

0:05:36