filmov

tv

Code A Simple Moving Average Stock Trading Strategy Using Python

Показать описание

#Programming #Python

Code A Simple Moving Average Stock Trading Strategy Using Python

Disclaimer: The material in this video is purely for educational purposes and should not be taken as professional investment advice. Invest at your own discretion.

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

⭐Please Subscribe !⭐

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

🐦🔥🐤 Support The Channel🐤🔥🐦

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

⭐Get the code and data sets or just support the channel by becoming a supporter on Patreon:

⭐Website:

⭐Helpful Python Programming Books

► Hands-Machine-Learning-Scikit-Learn-TensorFlow:

► Learning Python:

►Head First Python:

Code A Simple Moving Average Stock Trading Strategy Using Python

Disclaimer: The material in this video is purely for educational purposes and should not be taken as professional investment advice. Invest at your own discretion.

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

⭐Please Subscribe !⭐

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

🐦🔥🐤 Support The Channel🐤🔥🐦

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

⭐Get the code and data sets or just support the channel by becoming a supporter on Patreon:

⭐Website:

⭐Helpful Python Programming Books

► Hands-Machine-Learning-Scikit-Learn-TensorFlow:

► Learning Python:

►Head First Python:

How to Trade Moving Averages (Part 1)

MQL4 Tutorial - Simple Moving Average Crossover Expert Advisor

Code a Simple Moving Average (SMA) Crossover Trading Strategy in Python

Simple Moving Average (SMA) in Python Pandas + Plotting

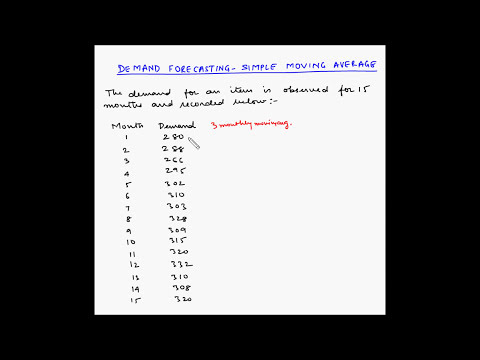

Forecasting - Simple moving average - Example 1

Moving Average for Python in 6 mins

Use Moving Averages Like A Pro ( 7 HACKS )

How To Add Moving Averages in Tradingview | What is the Best Moving Average? | SMA vs EMA Trading

MOVING AVERAGES AS A TRADING STRATEGY

Stock Trading: Moving Averages

What is a moving average? Calculating a simple moving average

How To Add Moving Averages on Tradingview | Trading Strategy

Simple Moving Average Stock Trading Strategy Using Python

How to Read Moving Averages |Explained For Beginners

The Ultimate Step-by-Step Moving Average Trading Guide (Full Training)

MQL4 TUTORIAL - SIMPLE MOVING AVERAGE SHIFT

The ONLY Moving Average Trading Guide You'll Ever Need

Code A Simple Moving Average Stock Trading Strategy Using Python

Simple Moving Average (SMA) - Technical Analysis

How to Trade Simple Moving Averages - Python Automation Tutorial

Explaining TradingView Moving Averages: Tutorial

What Is The Simple Moving Average? (SMA) & How To Use It!

BEST Moving Average Strategy for Daytrading Forex (Easy Crossover Strategy)

Easy Moving Average Strategy Explained (Free Source Code)

Комментарии

0:04:39

0:04:39

0:05:20

0:05:20

0:27:40

0:27:40

0:09:49

0:09:49

0:10:30

0:10:30

0:06:59

0:06:59

0:11:31

0:11:31

0:03:23

0:03:23

0:08:34

0:08:34

0:04:42

0:04:42

0:04:21

0:04:21

0:01:18

0:01:18

0:16:35

0:16:35

0:01:58

0:01:58

0:41:10

0:41:10

0:07:46

0:07:46

0:08:06

0:08:06

0:19:03

0:19:03

0:05:44

0:05:44

0:08:06

0:08:06

0:27:06

0:27:06

0:04:03

0:04:03

0:09:08

0:09:08

0:18:17

0:18:17