filmov

tv

The Automatic Millionaire // 10 Invaluable Lessons

Показать описание

Timecodes:

0:00 - Intro

0:38 - What Matters Is How Much You Spend, Not How Much You Earn

1:50 - Very Few People Are Born To Budget

2:51 - Try Shortform

3:51 - Track Your Spending

5:13 - Find Your Latte Factor

6:25 - You Don’t Need Discipline To Become A Millionaire

7:40 - Pay Yourself First

8:58 - FREE 1-Page PDF

9:12 - You Can Still Get Rich By Being An Employee

9:58 - Pre-Tax Retirement Plans Are Where Wealth Starts

11:17 - Emergency Fund = Good Night Sleep

12:12 - Strive For A Debt Free Lifestyle

------------

FAVORITE TOOLS:

LINKS:

DISCLAIMER: I am not a financial adviser. These videos are for educational and entertainment purposes only. I am merely sharing my personal opinion. Please seek professional help when needed.

The Automatic Millionaire by David Bach | Retire on $10 A Day

The Automatic Millionaire // 10 Invaluable Lessons

10 LESSONS & BEST IDEAS From The Automatic MILLIONAIRE By David Bach

THE AUTOMATIC MILLIONAIRE SUMMARY (BY DAVID BACH)

The Automatic Millionaire | Summary In Under 10 Minutes (Book by David Bach)

The Automatic Millionaire by David Bach Summary - How To Become An Automatic Millionaire - Animated

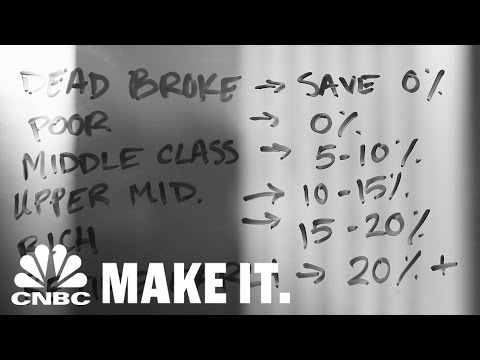

'The Automatic Millionaire' Shares Formula For Getting Rich | CNBC Make It.

The Automatic Millionaire | David Bach | Book Summary

🔍 Larry Dexter and the Bank Mystery 🕵️♂️ | A Classic Detective Adventure by Raymond Sperry 🏦...

The Automatic Millionaire by David Bach - TOP 5 LESSONS | Book Summary

Top 10 Financial Learnings from 'The Automatic Millionaire' by David Bach

The Automatic Millionaire: PAGES

The Automatic Millionaire Baby: #10

The AUTOMATIC MILLIONAIRE - (Investing for Beginners)

Money Rules – with David Bach, Author of The Automatic Millionaire #110

The Automatic Millionaire by David Bach : Blueprint to Financial Freedom

How to Be a Millionaire on a Low SALARY? AUTOMATIC MILLIONAIRE

“The Automatic Millionaire” by David Bach(Life-Changing 10 Minute Summary)

10 Key Learnings From The Book - Automatic Millionaire By David Bach | Sparsh Kochar

The Automatic Millionaire 📙

The Automatic Millionaire Summary || Get Rich Slow , the automatic millionaire by david bach

The Automatic Millionaire | Financial Lessons Speedrun in 10 Minutes

The Automatic Millionaire by David Bach

Building Wealth on Autopilot: A Summary of The Automatic Millionaire | David Bach | Finance Book

Комментарии

0:05:01

0:05:01

0:13:19

0:13:19

0:02:18

0:02:18

0:12:06

0:12:06

0:09:02

0:09:02

0:03:35

0:03:35

0:01:07

0:01:07

0:13:42

0:13:42

4:12:11

4:12:11

0:08:51

0:08:51

0:04:51

0:04:51

0:01:14

0:01:14

0:00:39

0:00:39

0:17:07

0:17:07

0:43:08

0:43:08

0:09:58

0:09:58

0:12:37

0:12:37

0:06:57

0:06:57

0:11:43

0:11:43

0:00:21

0:00:21

0:07:45

0:07:45

0:11:09

0:11:09

0:00:18

0:00:18

0:01:57

0:01:57