filmov

tv

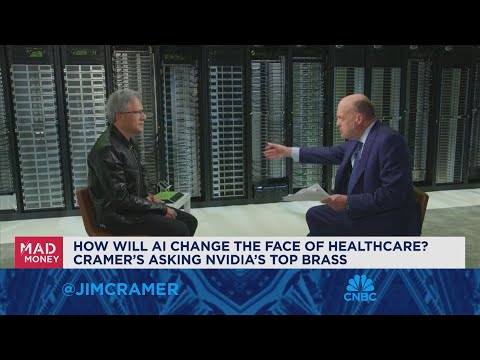

Jim Cramer talks Nvidia's partnerships and how they can offer up new investing ideas

Показать описание

'Mad Money' host Jim Cramer talks what Nvidia's partnerships could mean for the investing landscape and your portfolio.

Jim Cramer talks Nvidia's partnerships and how they can offer up new investing ideas

Jim Cramer talks the rise of Nvidia and impact of CEO Jensen Huang

Nvidia CEO Jensen Huang goes one-on-one with Jim Cramer

I don't want to be oblivious to Nvidia's massive run, says Jim Cramer

Jim Cramer discusses how Nvidia's products impact different fields

Jim Cramer on Nvidia GTC conference

Cramer’s Stop Trading: Nvidia

Nvidia's a market maker, not share taker, says CEO Jensen Huang

Jim Cramer eyes Nvidia and its AI potential after last year's gains

S3 Partner's Ihor Dusaniwsky talks what to make of Nvidia's short interest

Nvidia CEO talks closing on $7 billion Mellanox deal

Jim Cramer talks how this week's Treasury auctions are impacting the stock market

Jim Cramer looks ahead to see if this market rally can continue

A.I. is a brand new computing platform you can program with your own language, says Nvidia CEO

Lightning Round: If I'm going to be in A.I. it's going to be NVIDIA

Jim Cramer looks at the market's green spots during the sell-off

Snowflake CEO joins Jim Cramer after earnings report drives stock higher

Mad Money – 7/17/24 | Audio Only

Jim Cramer previews the week ahead of earnings reports from Allergan, Lyft, Nvidia and more

Jim Cramer: Investors concerned with spikes in Covid-19 cases should buy these stocks

Jim Cramer looks ahead to next week's market game plan

Right now Disney's board seems 'downright unfocused', says Jim Cramer

Nvidia 2024 AI Event: Everything Revealed in 16 Minutes

A Look Inside Sam Bankman-Fried’s FTX Empire Before It Collapsed

Комментарии

0:09:33

0:09:33

0:11:18

0:11:18

0:11:47

0:11:47

0:04:21

0:04:21

0:11:13

0:11:13

0:05:55

0:05:55

0:03:02

0:03:02

0:10:52

0:10:52

0:10:27

0:10:27

0:04:41

0:04:41

0:10:50

0:10:50

0:11:18

0:11:18

0:11:17

0:11:17

0:10:30

0:10:30

0:04:22

0:04:22

0:12:36

0:12:36

0:08:37

0:08:37

0:44:06

0:44:06

0:10:11

0:10:11

0:04:36

0:04:36

0:12:30

0:12:30

0:02:46

0:02:46

0:16:00

0:16:00

0:00:48

0:00:48