filmov

tv

Basic Principles of Central Clearing (FRM Part 1 2023 – Book 3 – Chapter 17)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading, you should be able to:

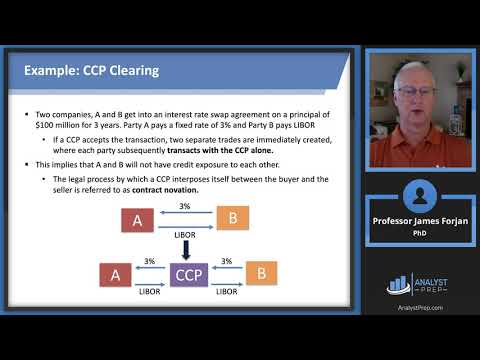

- Provide examples of the mechanics of a central counterparty (CCP).

- Describe advantages and disadvantages of central clearing of OTC derivatives.

- Compare margin requirements in centrally cleared and bilateral markets, and explain how margin can mitigate risk.

- Compare and contrast bilateral markets to the use of novation and netting.

- Assess the impact of central clearing on the broader financial markets.

Basic Principles of Central Clearing (FRM Part 1 2023 – Book 3 – Chapter 17)

What are Central Counterparties (CCPs)?

What is a clearing house?

Clearing - Counterparty risk | Trading operations

Futures and central clearing

Central counterparty clearing house (CCP)

What Is Clearing?

Understanding the Role of Clearing Houses in Financial Markets

Final Paper 5: ITL | Topic: Importation and Exportation of Goods | Session 2 | 19 Oct, 2024

New EU rules for safer Central Counterparties (CCPs)

Central clearing: what it is and the impact of active accounts

LFS Webcast series - Central Counterparties and Mandatory Clearing of OTC Derivatives

OTC Derivatives under Central Clearing

Basic Principles of UPSCprep courses

Debt Free and Prospering Because of One Biblical Principle

Central Counterparties (CCP) - Managing Systemic Risk

Exchanges, OTC Derivatives, DPCs, and SPVs (FRM Part 1 2023 – Book 3 – Chapter 5)

Regulation of OTC Derivatives Market (FRM Part 2 2023 – Book 3 – Chapter 18)

CISI - Derivatives, Principles of Clearing

Buy-side opportunities in central clearing

Lee McCormack on Central Clearing of OTC Derivatives: Collateral; Margin; Capital Requirements

The role of CCPs on Energy Markets - Tamás Horváth, COO of KELER CCP

[BCS] Broker forex FX CENTRAL CLEARING

Benefits of Clearing

Комментарии

0:18:04

0:18:04

0:03:01

0:03:01

0:02:33

0:02:33

0:01:08

0:01:08

0:08:10

0:08:10

0:00:27

0:00:27

0:02:05

0:02:05

0:06:42

0:06:42

2:59:29

2:59:29

0:01:34

0:01:34

1:00:35

1:00:35

0:02:57

0:02:57

0:10:19

0:10:19

0:00:49

0:00:49

0:01:49

0:01:49

0:18:36

0:18:36

0:24:20

0:24:20

0:21:54

0:21:54

0:27:55

0:27:55

0:08:58

0:08:58

0:26:11

0:26:11

0:18:14

0:18:14

![[BCS] Broker forex](https://i.ytimg.com/vi/F4nJaDrcuv0/hqdefault.jpg) 0:00:41

0:00:41

0:01:00

0:01:00