filmov

tv

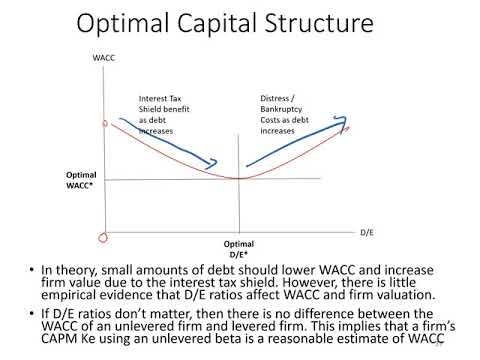

WACC and Optimal Capital Structure

Показать описание

The weighted average cost of capital is based on optimal capital structure - We explain!

WACC and Optimal Capital Structure

🔴 3 Minutes! Weighted Average Cost of Capital or WACC Explained (Quickest Overview)

AdvFinMod Topic 22 Section 6 WACC and Optimal Capital Structure

Finance Core Topic #7 Section #6 Optimal Capital Structure and WACC

Capital structure of firms. optimal capital structure. WACC

Determination of WACC and Optimal Capital Structure

Course 6 Optimal capital structure Part 01

WACC and Capital Structure

Optimal Capital Structure. CPA Exam BAR

QoD #1: Capital structure weights in the WACC - Gross debt or net debt?

Course 6 Optimal capital structure Part 02

Course 6 Optimal capital structure Part 03

Capital Structure

In Practice Webcast #10: Estimating an Optimal Debt Ratio

What is the optimal capital structure? - Super Basics

Ch 13 Part 2. Optimal Capital Structure Theory

Course 6 Optimal capital structure Part 04

Capital Structure and WACC (Weighted Average Cost of Capital)

Part-1: Optimal Capital Structure with Un-levered beta

Weighted Average cost of Capital (WACC) under Book Value Approach ~ Financial Management

15-10 Optimal Capital Structure with Hamada

Capital Structure Explained for Dummies | Debt, Equity, Stock | Balance Sheets

MBA FIN13 5 WACC - Capital structure weights

Optimal Capital Structure||How to Determine Optimal Capital Structure using Gearing Ratio||Leverage

Комментарии

0:15:04

0:15:04

0:02:16

0:02:16

0:04:33

0:04:33

0:09:10

0:09:10

0:07:27

0:07:27

0:55:05

0:55:05

0:05:04

0:05:04

0:02:16

0:02:16

0:17:51

0:17:51

0:06:07

0:06:07

0:05:04

0:05:04

0:05:04

0:05:04

0:03:57

0:03:57

0:19:49

0:19:49

0:04:20

0:04:20

0:13:57

0:13:57

0:05:04

0:05:04

0:06:00

0:06:00

0:27:44

0:27:44

0:10:02

0:10:02

0:07:22

0:07:22

0:03:51

0:03:51

0:07:40

0:07:40

0:09:36

0:09:36