filmov

tv

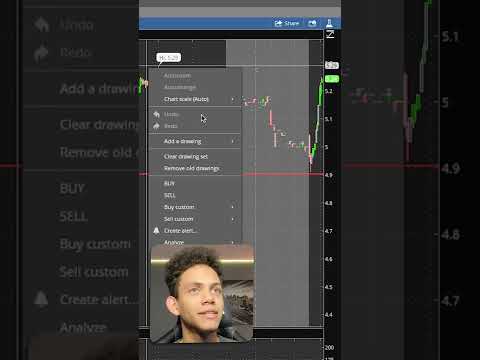

How To Short A Stock As A Beginner (Step-By-Step)

Показать описание

How to Short a Stock? Typically, you might decide to short a stock because you feel it is overvalued or will decline for some reason. Since shorting involves borrowing shares of stock you don't own and selling them, a decline in the share price will let you buy back the shares with less money than you originally received when you sold them.

● MESSAGE ME ON INSTAGRAM!

For those who are interested in Trading & Investing, I encourage you to join Our Free Trading Group of over 310,000!

Thank you for the support, the best way to reach out to me is through our private discord chat, please DM me.

The Stock Market falling/ crashing can be a scary thing when you are not informed on how to make money during a stock market crash! The corona virus isn't getting any better and opportunity is among us, let's take time to inform ourselves and make the most of this opportunity!

If you have any suggestions for future videos such as Day Trading, Investing, Stock Market, Real Estate, Car Sales, Robinhood, TD Ameritrade, Crypto & bitcoin, Entrepreneurship, Forex, Online Marketing, Online Sales or fun daily vlogs. Please let me know.

How much money do you need to short a stock? Since shorting a stock requires a margin account, this minimum margin requirement applies to short sales as well. Many firms, including Charles Schwab and Fidelity, require you to have at least $5,000 in your account if you want to sell a stock short.

Sometimes investors become convinced that a stock is more likely to fall in value than to rise. If that's the case, investors can potentially make money when the value of a stock goes down by using a strategy called short selling. Also known as shorting a stock, short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- but can also lose money for you if the stock price goes up.

How To Short A Stock: A Practical Guide. Selling a stock short makes it possible for an investor to profit from falling prices. But short selling can also introduce greater market risk compared to normal stock trading.

What Is Short Selling. Short selling, or to "sell short," means that an investor, or short seller, borrows shares/units of an investment security, usually from a broker, and sells the borrowed security, expecting that the share price will fall. If the share price does fall, the investor buys those same shares/units back at a lower price and can make a profit. The short seller then returns the borrowed security to the lender.

● MESSAGE ME ON INSTAGRAM!

For those who are interested in Trading & Investing, I encourage you to join Our Free Trading Group of over 310,000!

Thank you for the support, the best way to reach out to me is through our private discord chat, please DM me.

The Stock Market falling/ crashing can be a scary thing when you are not informed on how to make money during a stock market crash! The corona virus isn't getting any better and opportunity is among us, let's take time to inform ourselves and make the most of this opportunity!

If you have any suggestions for future videos such as Day Trading, Investing, Stock Market, Real Estate, Car Sales, Robinhood, TD Ameritrade, Crypto & bitcoin, Entrepreneurship, Forex, Online Marketing, Online Sales or fun daily vlogs. Please let me know.

How much money do you need to short a stock? Since shorting a stock requires a margin account, this minimum margin requirement applies to short sales as well. Many firms, including Charles Schwab and Fidelity, require you to have at least $5,000 in your account if you want to sell a stock short.

Sometimes investors become convinced that a stock is more likely to fall in value than to rise. If that's the case, investors can potentially make money when the value of a stock goes down by using a strategy called short selling. Also known as shorting a stock, short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- but can also lose money for you if the stock price goes up.

How To Short A Stock: A Practical Guide. Selling a stock short makes it possible for an investor to profit from falling prices. But short selling can also introduce greater market risk compared to normal stock trading.

What Is Short Selling. Short selling, or to "sell short," means that an investor, or short seller, borrows shares/units of an investment security, usually from a broker, and sells the borrowed security, expecting that the share price will fall. If the share price does fall, the investor buys those same shares/units back at a lower price and can make a profit. The short seller then returns the borrowed security to the lender.

Комментарии

0:03:00

0:03:00

0:16:14

0:16:14

0:08:51

0:08:51

0:09:57

0:09:57

0:09:41

0:09:41

0:19:37

0:19:37

0:02:59

0:02:59

0:00:33

0:00:33

0:04:46

0:04:46

0:21:46

0:21:46

0:10:02

0:10:02

0:00:48

0:00:48

0:12:10

0:12:10

0:11:57

0:11:57

0:13:59

0:13:59

0:49:47

0:49:47

0:06:37

0:06:37

0:10:30

0:10:30

0:10:45

0:10:45

0:14:15

0:14:15

0:10:40

0:10:40

0:09:08

0:09:08

0:14:44

0:14:44

0:01:24

0:01:24