filmov

tv

Collateralized Debt Obligations (CDOs) Explained in One Minute: Definition, Risk, Tranches, etc.

Показать описание

Quite a few people who aren't necessarily economists know what Mortgage-Backed Securities are in light of the fact that after the Great Recession, they've received extensive coverage, to the point of becoming (in)famous.

But Collateralized Debt Obligations or CDOs... less so. Unfortunately, this means that people ended up having a superficial understanding of the entire mortgage debacle at best in light of the fact that if you don't know what Collateralized Debt Obligations are and how they work, you aren't even scratching the proverbial surface.

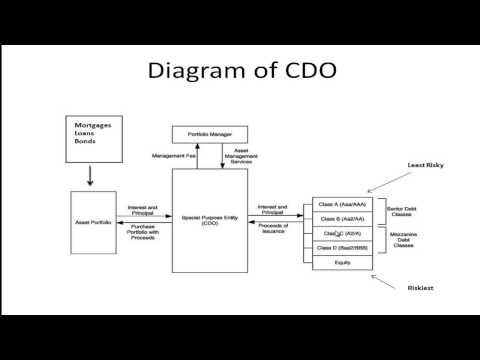

To keep it simple, think of Mortgage-Backed Securities as a specific Collateralized Debt Obligation type, where only mortgages are used, as the name suggests. When it comes to CDOs, we are therefore dealing with a broader term that encompasses a wide range of different debt types, from personal loans to corporate debt.

From definition to specifics, this video explains what CDOs are and how they work. We'll be covering the risk dimension as well, including the tranches those in movies such as The Big Short have tried to explain. Fortunately, as complicated as Collateralized Debt Obligations are, it's not that difficult to wrap your head around how things actually work... if the right economist offers to explain the process ;)

But Collateralized Debt Obligations or CDOs... less so. Unfortunately, this means that people ended up having a superficial understanding of the entire mortgage debacle at best in light of the fact that if you don't know what Collateralized Debt Obligations are and how they work, you aren't even scratching the proverbial surface.

To keep it simple, think of Mortgage-Backed Securities as a specific Collateralized Debt Obligation type, where only mortgages are used, as the name suggests. When it comes to CDOs, we are therefore dealing with a broader term that encompasses a wide range of different debt types, from personal loans to corporate debt.

From definition to specifics, this video explains what CDOs are and how they work. We'll be covering the risk dimension as well, including the tranches those in movies such as The Big Short have tried to explain. Fortunately, as complicated as Collateralized Debt Obligations are, it's not that difficult to wrap your head around how things actually work... if the right economist offers to explain the process ;)

Комментарии

0:01:56

0:01:56

0:08:57

0:08:57

0:04:01

0:04:01

0:04:19

0:04:19

0:05:16

0:05:16

0:10:27

0:10:27

0:01:44

0:01:44

0:12:33

0:12:33

0:13:50

0:13:50

0:01:28

0:01:28

0:07:39

0:07:39

0:04:05

0:04:05

0:07:11

0:07:11

0:01:59

0:01:59

0:09:31

0:09:31

0:05:50

0:05:50

0:10:55

0:10:55

0:00:58

0:00:58

0:00:15

0:00:15

0:01:15

0:01:15

0:14:24

0:14:24

0:00:56

0:00:56

0:00:49

0:00:49

0:00:29

0:00:29