filmov

tv

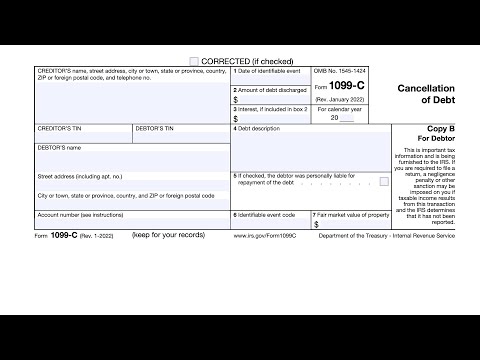

IRS Form 1099-C walkthrough (Cancellation of Debt)

Показать описание

Here are links to articles we've written about other tax forms mentioned in this video:

IRS Schedule 1, Additional Income and Adjustments to Income

IRS Schedule C, Profit or Loss from Business (Sole Proprietorship)

IRS Schedule E, Supplemental Income

IRS Schedule F, Profit or Loss from Farming

IRS Form 4835, Farm Rental Income and Expenses

IRS Form 8822, Change of Address

IRS Form 8822-B, Change of Address or Responsible Party (Business)

IRS Form 1099-C walkthrough (Cancellation of Debt)

IRS Form 1099C Cancellation of Debt

IRS Form 1099-C Explained with Form 982 for Cancelled Debts

1099-C Form, Explained.

The “Who , What , When , Where and How” on 1099 c’s

Form 1099-C & Form 982 - Cancelled Debt Taxable Income Exclusions

1099 C Cancellation of Debt Explained

IRS 1099c canceled debt

IRS Form 4952 walkthrough (Investment Interest Expense Deduction)

How to Fill Out Form 1099-C or Cancellation of Debt | PDFRun

IRS Form 1099-C Explained: How to Report on Form 1040

IRS Form 1099C Canceled Debt [5 facts] You should know

How do you report canceled debt on your taxes? IRS Form 1099-C

Maximizing Tax Benefits: Reporting 1099-C Debt Cancellation Income

1099C Cancellation of Debt

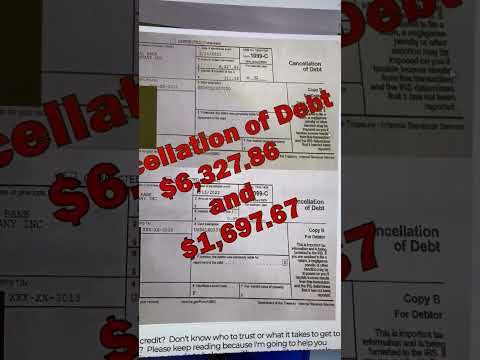

1099-C Cancellation of Debt For Credit Cards - How To Get Out Of It As Taxable Income

Cancellation of Credit Card Debt on Tax form 1099-C

What to do about a 1099-C Debt Cancellation form to the IRS

1099 C CANCELLATION OF DEBT || IRS REQUIREMENTS FOR FILING 1099C

IRS Form 1099-A Walkthrough (Acquisition or Abandonment of Secured Property)

How to File 1099-A and 1099-C in TaxSlayer Pro Web

Cancelled Debt Income is Taxable! Use IRS Form 982 to Reduce Taxes on COD Income

Cancelled Debts, Bankruptcy, IRS Form 1099C

1099c cancellation of debt IRS you don’t owe collections anymore

Комментарии

0:10:37

0:10:37

0:02:26

0:02:26

0:17:39

0:17:39

0:02:12

0:02:12

0:03:01

0:03:01

0:15:58

0:15:58

0:17:21

0:17:21

0:00:58

0:00:58

0:18:05

0:18:05

0:02:28

0:02:28

0:08:29

0:08:29

0:02:01

0:02:01

0:04:06

0:04:06

0:07:40

0:07:40

0:00:47

0:00:47

0:01:22

0:01:22

0:08:24

0:08:24

0:10:08

0:10:08

0:00:58

0:00:58

0:11:32

0:11:32

0:32:17

0:32:17

0:09:01

0:09:01

0:03:54

0:03:54

0:00:55

0:00:55