filmov

tv

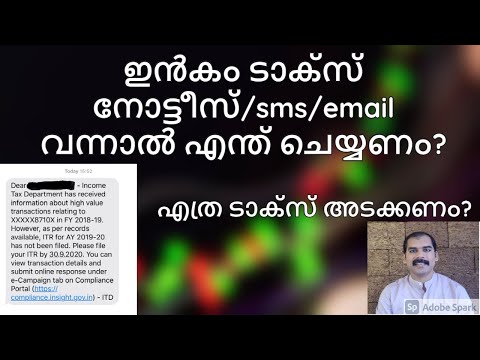

'PAN Flagged' Income Tax Notice Malayalam -CA Subin VR

Показать описание

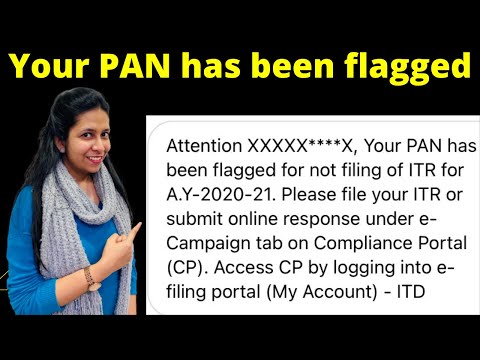

This narrates how to respond to Income Tax Notice Malayalam and Income Tax SMS, Income Tax Emails for High value transactions alert. Whether you have to pay Income Tax upon receiving such notice.Watch this malayalam financial video to understand more about income tax.

#Income Tax Notice Malayalam# flagged for not filing# PAN has been flagged#

If you need any clarification/opinion viewers may send message to the below direct link

Channel's WhatsApp Number 7012243098

Viewers may also check for other articles and similar contents at the below links.

For share trading inputs:

Disclaimer: This video is intended for education purpose only and not for the purpose of soliciting business. The viewers shall take professional advice before taking any decisions on the matters specified in the video. The matters discussed in the video may subject to change due to amendments in various Acts/Rules etc. This channel will not responsible for any damages caused to the viewers.

for the detailed information on disclaimer please visit the link below.

See this video before you watching:-

everything you need to know about Indian Income Tax FY 2019-20,

the different income tax slabs, how income tax is calculated, basics of income tax etc..

the latest changes and amendments in the Indian Income Tax Slabs, Income Tax Rates

and Income Tax Calculations.

what changes have been implemented regarding income tax, how to calculate income tax, how to pay income tax etc

#Income Tax Notice Malayalam# flagged for not filing# PAN has been flagged#

If you need any clarification/opinion viewers may send message to the below direct link

Channel's WhatsApp Number 7012243098

Viewers may also check for other articles and similar contents at the below links.

For share trading inputs:

Disclaimer: This video is intended for education purpose only and not for the purpose of soliciting business. The viewers shall take professional advice before taking any decisions on the matters specified in the video. The matters discussed in the video may subject to change due to amendments in various Acts/Rules etc. This channel will not responsible for any damages caused to the viewers.

for the detailed information on disclaimer please visit the link below.

See this video before you watching:-

everything you need to know about Indian Income Tax FY 2019-20,

the different income tax slabs, how income tax is calculated, basics of income tax etc..

the latest changes and amendments in the Indian Income Tax Slabs, Income Tax Rates

and Income Tax Calculations.

what changes have been implemented regarding income tax, how to calculate income tax, how to pay income tax etc

Комментарии

0:16:10

0:16:10

0:07:57

0:07:57

0:12:52

0:12:52

0:04:36

0:04:36

0:10:38

0:10:38

0:07:52

0:07:52

0:06:42

0:06:42

0:08:40

0:08:40

0:08:01

0:08:01

0:06:42

0:06:42

0:19:06

0:19:06

0:06:22

0:06:22

0:04:35

0:04:35

0:08:08

0:08:08

0:09:30

0:09:30

0:05:09

0:05:09

0:07:07

0:07:07

0:06:58

0:06:58

0:07:48

0:07:48

0:06:48

0:06:48

0:04:33

0:04:33

0:06:53

0:06:53

0:09:53

0:09:53

0:04:16

0:04:16