filmov

tv

German 🇩🇪 salary tax breakdown

Показать описание

The German tax system is so complex that even someone like Sheldon Cooper might find it baffling. With six tax classes, your tax burden depends on your marital status—whether you’re single, married, or a single parent. If you’re married, it also depends on whether you and your spouse have similar incomes or if one earns significantly more than the other. And if you decide to take on a second job, brace yourself—this job will fall under a special tax class with the highest rates! 😵💫

But that’s just the beginning. Your tax rate depends on how much you earn, starting at 14% and going up to 42% as your salary increases. If your income exceeds EUR 66,761, you’ll be taxed at a flat 42%. 💸

On top of income taxes, there’s the church tax. If you don’t declare yourself non-religious when registering in Germany, you’ll automatically be signed up to pay this tax, adding another 8-9% on top of your income tax. ✝️💶

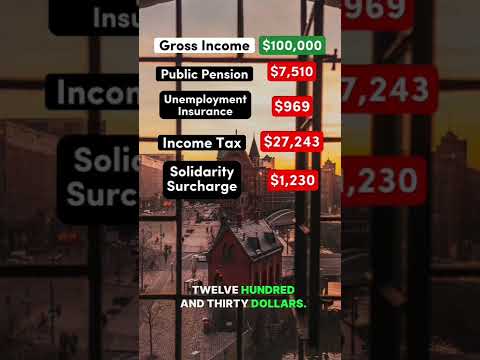

Germany also has a solidarity tax, a holdover from when West Germany supported East Germany. Since 2021, however, this tax only applies to those earning above EUR 84,000 annually. 💼

Then there are the social contributions deducted from your payslip, such as pension, unemployment, and health insurance. These can significantly reduce your take-home pay. 📉

🧾 This is why it’s crucial to use an online gross-to-net calculator when negotiating your salary in Germany. Employers typically discuss gross salaries, so it’s up to you to figure out your actual net income.

But there’s a silver lining—sometimes, the German tax system gives money back. Filing a tax return is recommended, and sometimes mandatory. You might be able to claim back expenses for relocation, work costs, or even home office expenses, leading to a potential refund at the end of the year. 💰

👶🛝 Thinking about working in Germany? Reach out and let's make your career dreams a reality!

👍 Like, 🔗 share, and ▶️ follow for more career tips and job advice!

📚 Start or grow your tech career with our Global Tech Career Guide 2024! Check out the link in our bio.

#careergrowth #germany #lifeingermany #workingermany #memes #taxes #salary #tax #money #career #careerdevelopment #expatlife #expats #newjob #workabroad #jobsearch #fun

But that’s just the beginning. Your tax rate depends on how much you earn, starting at 14% and going up to 42% as your salary increases. If your income exceeds EUR 66,761, you’ll be taxed at a flat 42%. 💸

On top of income taxes, there’s the church tax. If you don’t declare yourself non-religious when registering in Germany, you’ll automatically be signed up to pay this tax, adding another 8-9% on top of your income tax. ✝️💶

Germany also has a solidarity tax, a holdover from when West Germany supported East Germany. Since 2021, however, this tax only applies to those earning above EUR 84,000 annually. 💼

Then there are the social contributions deducted from your payslip, such as pension, unemployment, and health insurance. These can significantly reduce your take-home pay. 📉

🧾 This is why it’s crucial to use an online gross-to-net calculator when negotiating your salary in Germany. Employers typically discuss gross salaries, so it’s up to you to figure out your actual net income.

But there’s a silver lining—sometimes, the German tax system gives money back. Filing a tax return is recommended, and sometimes mandatory. You might be able to claim back expenses for relocation, work costs, or even home office expenses, leading to a potential refund at the end of the year. 💰

👶🛝 Thinking about working in Germany? Reach out and let's make your career dreams a reality!

👍 Like, 🔗 share, and ▶️ follow for more career tips and job advice!

📚 Start or grow your tech career with our Global Tech Career Guide 2024! Check out the link in our bio.

#careergrowth #germany #lifeingermany #workingermany #memes #taxes #salary #tax #money #career #careerdevelopment #expatlife #expats #newjob #workabroad #jobsearch #fun

0:12:15

0:12:15

0:00:10

0:00:10

0:07:03

0:07:03

0:12:23

0:12:23

0:05:59

0:05:59

0:00:38

0:00:38

0:02:59

0:02:59

0:09:09

0:09:09

0:10:26

0:10:26

0:07:33

0:07:33

0:03:32

0:03:32

0:00:52

0:00:52

0:00:39

0:00:39

0:09:38

0:09:38

0:00:47

0:00:47

0:23:09

0:23:09

0:05:55

0:05:55

0:05:15

0:05:15

0:10:14

0:10:14

0:00:08

0:00:08

0:14:58

0:14:58

0:02:57

0:02:57

0:00:40

0:00:40

0:18:01

0:18:01