filmov

tv

Calculation of Bonus | Bonus Act Vs. Wage Code - Part II

Показать описание

#Bonus #WageCode #GovindRajNS #3LRPartner #MinimumWages #IncomeTax #ProfessionalTax

It specifically addresses Set-On and Set-Off Concepts and also Bonus liability for contract labours. This video also explains how your bonus can be calculated and also compares the current law as per Payment of Bonus Act 1965 and Wage Code 2019. It answers connected questions with examples.

It specifically addresses Set-On and Set-Off Concepts and also Bonus liability for contract labours. This video also explains how your bonus can be calculated and also compares the current law as per Payment of Bonus Act 1965 and Wage Code 2019. It answers connected questions with examples.

Calculation of Statutory Bonus #salary #salaryslip #india #freshers #funny #careeradvice

✅Payment of BONUS ACT & amendments | DIWALI bonus calculation in Excel Sheet

How to Calculate Bonus in Excel 2010 or Later

Calculating Bonuses

Add 20% Bonus in Employee Salary in Excel - Tips & Tricks from @todfodeducation

Calculate Salary Bonus 35% via Basic pay easily on phone calculater

How to Create a Bonus Calculation for Your Team

How to calculate Bonus

Cash planning Dec No 4

Employees Salary Bonus Calculation in Excel #shorts #exceltips #bonuscalculation

🌐How to calculate bonus under payment of bonus act 1965

Bonus calculation as per Bonus act 1965 in Tamil. Bonus calculation formula explained.

How to Calculate Bonus in Excel | Bonus Calculation Formula #ExcelTutorial #CalculateBonus #Excel

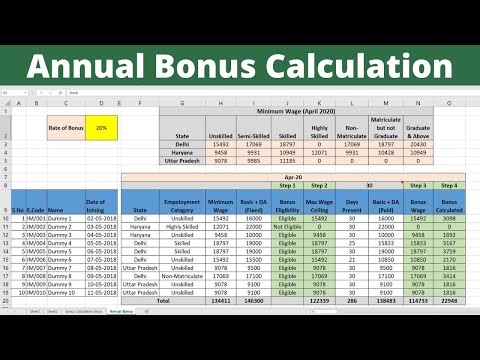

Annual Bonus Calculation | Annual Bonus Sheet correct Calculation

Bonus Calculation - Easy Steps | Diwali Bonus - 4 | Eduguru | Manikandan A

Ex1-SalesAnalysis: Calculating Bonus with IF function

Salary Structure – Employee Bonus Systems

Bonus is your legal right #LLAShorts 18

How To Calculate Bonus | Payment of Bonus Act 1965 | Bonus Calculation Steps

Calculate Bonus in Excel Using IF Function

Add 10% Bonus in Employee Salary in Excel #excel #exceltips #exceltutorial #msexcel #microsoftexcel

Statutory Bonus eligibility #india #motivation #freshers #bonus #car #salarysalary #sleep

Do I Have A Right To A Bonus? #bonus #southafricanlaw #employmentlaw

Bonus Calculation | How to calculate Bonus in payroll #payrollprocessing #bonus #readytogetupdate

Комментарии

0:00:08

0:00:08

0:09:24

0:09:24

0:01:34

0:01:34

0:02:43

0:02:43

0:00:12

0:00:12

0:00:16

0:00:16

0:07:06

0:07:06

0:00:10

0:00:10

0:12:06

0:12:06

0:00:29

0:00:29

0:00:25

0:00:25

0:11:02

0:11:02

0:00:43

0:00:43

0:08:47

0:08:47

0:01:00

0:01:00

0:07:43

0:07:43

0:03:23

0:03:23

0:00:57

0:00:57

0:15:00

0:15:00

0:06:52

0:06:52

0:00:23

0:00:23

0:00:07

0:00:07

0:00:30

0:00:30

0:25:43

0:25:43