filmov

tv

What is CASH BASIS accounting? UK small business basics

Показать описание

As part of UK Self Assessment tax you can chose to keep records based on the Cash Basis or Traditional Accounting schemes. In this video I explain what Cash Basis or Cash Accounting means and why you might want to use it as a simpler alternative to Traditional or Accruals (GAAP) based accounts. Remember to always seek professional help from an Accountant and don't forget to Subscribe and Share for more small business tips!

Here's some affiliate links to services I use or would consider using. If you think they would be a good match for your business please use these links - many include offers exclusive to this channel. Read more about affiliate links at the bottom of this description:

⚠️ Disclaimer ⚠️

#SmallBusiness #BusinessTips #SelfEmployed

Here's some affiliate links to services I use or would consider using. If you think they would be a good match for your business please use these links - many include offers exclusive to this channel. Read more about affiliate links at the bottom of this description:

⚠️ Disclaimer ⚠️

#SmallBusiness #BusinessTips #SelfEmployed

Cash vs Accrual Accounting Explained With A Story

Cash Accounting: How it Works & Should You Use It?

What is CASH BASIS accounting? UK small business basics

Why Cash Accounting is MISLEADING!! Accrual vs. Cash Accounting Explained

Cash Basis vs Accrual Basis

Cash vs. Accrual Basis Accounting

Cash Basis for 2023 to 2024 and simplified expenses

CASH BASIS ACCOUNTING AND ACCRUAL BASIS ACCOUNTING/ACCOUNTANT INTERVIEW QUESTION

Customer, Accounts Receivable, or Revenue Cycle 1300 QuickBooks Online

What is the CASH BASIS for UK self assessment tax?

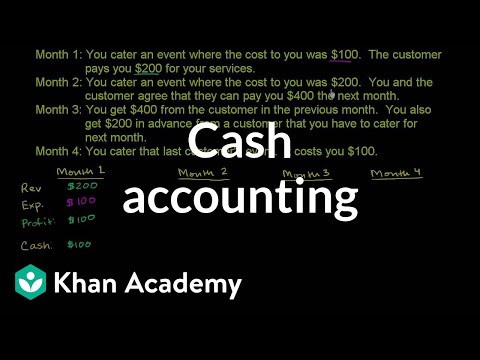

Cash accounting | Accounting and financial statements | Finance & Capital Markets | Khan Academy

Cash Basis vs. Accrual Basis Accounting Explained: Which Is Right for Your Business?

Cash Basis and Accrual Basis of Accounting

Cash Basis Accounting Definition - What is Cash Basis Accounting?

What is the CASH METHOD of Accounting?

Cash Accounting vs Accrual Accounting | Difference between Cash Accounting and Accrual Accounting

Accrual Accounting: How it Works & Why it's #1!

Cash basis | Odoo Accounting

Accrual Basis & Cash Basis: What, Why & How? । Emon's

#12 Cash Basis V/S Accrual Basis Accounting| | 11th Accounts | CA-Foundation

Cash Basis and Accrual Basis | XI Account 2021-22. Easily explained Meaning, difference & Numeri...

Cash and Accrual accounting system part 5

Accrual vs Cash Basis Accounting - Financial Accounting

Cash vs Accrual Accounting: Which is Best for Your Business?

Комментарии

0:11:00

0:11:00

0:05:42

0:05:42

0:07:05

0:07:05

0:12:28

0:12:28

0:01:00

0:01:00

0:00:39

0:00:39

0:01:42

0:01:42

0:09:02

0:09:02

0:32:07

0:32:07

0:11:02

0:11:02

0:03:59

0:03:59

0:16:16

0:16:16

0:00:59

0:00:59

0:03:10

0:03:10

0:00:31

0:00:31

0:03:05

0:03:05

0:07:06

0:07:06

0:04:46

0:04:46

0:06:20

0:06:20

0:33:26

0:33:26

0:22:13

0:22:13

0:13:54

0:13:54

0:01:58

0:01:58

0:11:20

0:11:20