filmov

tv

How To Use CORRELATIONS To Pick Direction In Options Trading (ThinkOrSwim Tutorial)

Показать описание

When it comes to identifying your directional assumption for a particular stock or ETF, one important factor to consider is its correlation to the broader market. This will provide a good estimation as to how the stock will move when, for example, the S&P 500 moves. And as a result, you can use correlations to guide your strategy selection. Sometimes you might find it necessary to make bearish trades (via call credit spreads, put debit spreads, short calls, long puts, short stock, etc.) in order to get bullish on the broader market! So in this video, I will provide a very detailed tutorial on how to leverage the correlation metrics and indicators in ThinkOrSwim in order to help you make smarter trades!

🔥 JOIN ME ON SKILLSHARE TOO!!! 🔥

*** Signing up for a Premium Skillshare membership with any of the links provided below will give you a 1 month FREE trial! ***

Chapters:

0:00 Introduction

1:47 Overview Of Correlation

4:25 How To Add Correlations To Your Watchlist

7:32 Example #1 (Negative Correlation)

9:52 Example #2 (Positive Correlation)

11:12 Example #3 (No Correlation)

12:31 How To Add Correlations To Your Charts

#tradinglessons #technicalanalysis #thinkorswim

🔥 JOIN ME ON SKILLSHARE TOO!!! 🔥

*** Signing up for a Premium Skillshare membership with any of the links provided below will give you a 1 month FREE trial! ***

Chapters:

0:00 Introduction

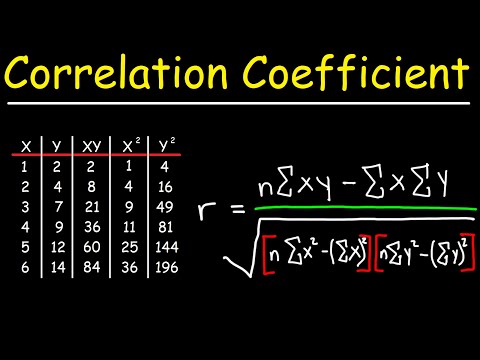

1:47 Overview Of Correlation

4:25 How To Add Correlations To Your Watchlist

7:32 Example #1 (Negative Correlation)

9:52 Example #2 (Positive Correlation)

11:12 Example #3 (No Correlation)

12:31 How To Add Correlations To Your Charts

#tradinglessons #technicalanalysis #thinkorswim

Комментарии

0:07:56

0:07:56

0:30:23

0:30:23

0:16:08

0:16:08

0:04:18

0:04:18

0:07:31

0:07:31

0:02:14

0:02:14

0:12:57

0:12:57

0:13:01

0:13:01

1:00:44

1:00:44

1:19:25

1:19:25

0:15:47

0:15:47

0:00:40

0:00:40

0:02:18

0:02:18

0:31:03

0:31:03

0:06:20

0:06:20

0:00:44

0:00:44

0:00:17

0:00:17

0:10:47

0:10:47

0:07:47

0:07:47

0:09:05

0:09:05

0:00:13

0:00:13

0:40:29

0:40:29

0:04:33

0:04:33

0:07:19

0:07:19