filmov

tv

The Anatomy Of The Rs 11,000 Crore PNB Fraud

Показать описание

Former RBI Deputy Governor R Gandhi and RK Bakshi, former director at Bank of Baroda talk to BloombergQuint about the modus operandi behind the Rs 11,000 crore fraud and why PNB finds itself in a corner.

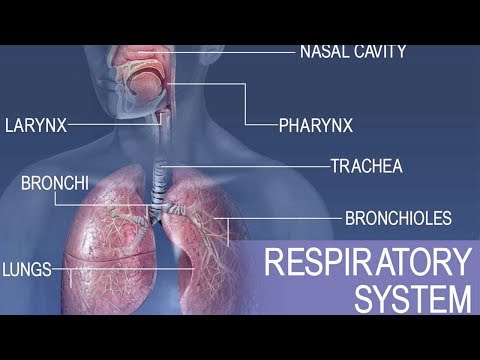

Anatomy and physiology of the respiratory system

Introduction to respiratory system anatomy

Anatomy of the Respiratory System - An Overview - Biology, Anatomy, and Physiology

Anatomy and physiology of Respiratory system

Respiratory | Mechanics of Breathing: Pressure Changes | Part 1

Macleod - RS / Part 1 : Anatomy & Physiology

Embryology | Development of the Respiratory System

Respiratory System Introduction - Part 1 (Nose to Bronchi) - 3D Anatomy Tutorial

Lungs: tissues and cells (preview) - Human Anatomy and Histology | Kenhub

Development of the Respiratory System | Stages of Lung Development | Embryology

Anatomy 6 | RS

Anatomy 5 | RS

Lecture 1 - Nasal Cavity : Anatomy (RS)

Lecture 6 - Lower respiratory tract II : Anatomy (RS)

Anatomy Short-Cut || RS by: Qutaibah Essam

RS - anatomy - lecture 1

Lecture 2 - Pharynx : Anatomy (RS)

This Anatomy App Will Blow Your Mind 🤯 #anatomy #3danatomy #sportstherapy

3D atlas of human anatomy and pathology absolutely FREE 🫁

Respiratory physiology lecture 1 - structure and anatomy of lungs and diaphragm - Part 1 anaesthesia

Anatomy Series - The Lower Respiratory Tract

Respiratory | Regulation of Breathing: Respiratory Centers: Part 1

Anatomy of Respiratory System, Part 1, Interesting Video with Amharic Speech

Ultrasound guided thoracic paravertebral block

Комментарии

0:10:29

0:10:29

0:25:09

0:25:09

0:16:08

0:16:08

0:07:04

0:07:04

0:31:41

0:31:41

0:09:16

0:09:16

0:45:11

0:45:11

0:03:37

0:03:37

0:03:40

0:03:40

0:10:14

0:10:14

0:53:06

0:53:06

0:51:35

0:51:35

1:30:03

1:30:03

1:01:40

1:01:40

1:28:32

1:28:32

0:52:46

0:52:46

0:50:00

0:50:00

0:00:39

0:00:39

0:00:08

0:00:08

0:27:04

0:27:04

0:05:16

0:05:16

0:13:33

0:13:33

0:51:19

0:51:19

0:09:37

0:09:37