filmov

tv

Which Is BEST CPF Retirement Sum?

Показать описание

ROBOADVISORS

CRYPTO

RESEARCH

PAYMENT

► DBS Paylah (free $5) CODE "AHVULE614"

LIFESTYLE

0:00 - Intro

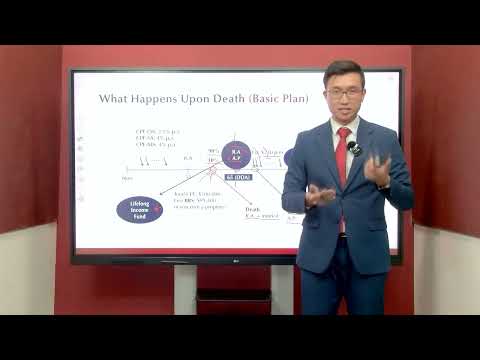

0:41 - What is CPF retirement sum?

2:53 - How much do we need for retirement?

4:52 - Caveats with CPF LIFE

10:24 - Which retirement sum should you go for?

12:53 - Conclusion

Which Is BEST CPF Retirement Sum?

The BEST CPF Life Plan? | Detailed Analysis

I Think CPF Enhanced Retirement Sum (ERS) Is Over-rated...

Can You Actually Retire On CPF Payouts?

Two ways to maximise CPF savings before turning 55 | Money Matters

CPF LIFE Standard, Basic or Escalating Plan: Which Should You Choose?

Choose the CPF LIFE plan that best supports your retirement lifestyle

JB Retirement - My RM32K Monthly CPF Life Powered Plan! Best Retirement Choice!

CPF Retirement Sum & CPF Life

Why I WON'T Top Up To CPF Enhancement Retirement Sum (ERS)

CPF Retirement Sum Scheme payouts to be capped at age 90 from January 2020

3 Benefits of Reaching CPF Full Retirement Sum Early

Double your cash top-ups to your CPF with the Matched Retirement Savings Scheme

Getting the most out of CPF LIFE. Full Retirement Sum or Enhanced Retirement Sum?

Why CPF Life Basic Plan Makes More Economic Sense

CPF Life Basic Plan surprisingly gives you more!

CPF SA closed: What should you do now?

CPF LIFE … Which Plan Should I Choose ?

Am I Missing Out – What’s So Great About CPF LIFE?

CPF in One Bite Ep 4: What is the best CPF LIFE plan for me?

Can YOU REALLY get to 'CPF Full Retirement Sum (FRS)' with MEDIAN INCOME?

How to Plan for your Retirement after the New CPF changes?

10 THINGS ABOUT CPF THAT YOU MAY NOT KNOW OF (Edition 2024) | Retirement Planning Singapore

CPF Retirement Calculator Detailed

Комментарии

0:13:05

0:13:05

0:11:35

0:11:35

0:12:17

0:12:17

0:11:36

0:11:36

0:02:50

0:02:50

0:24:30

0:24:30

0:01:30

0:01:30

0:19:17

0:19:17

0:03:03

0:03:03

0:12:09

0:12:09

0:01:14

0:01:14

0:08:20

0:08:20

0:00:31

0:00:31

0:07:53

0:07:53

0:03:14

0:03:14

0:05:33

0:05:33

0:15:26

0:15:26

0:09:09

0:09:09

0:02:30

0:02:30

0:02:52

0:02:52

0:12:02

0:12:02

0:08:45

0:08:45

0:15:05

0:15:05

0:06:35

0:06:35