filmov

tv

The Stock Market is Rigged Against You

Показать описание

The stock market is rigged against you. Why? And should you invest your money if this is the case? Find out in the video above!

Join the community of like-minded investors:

_____________________________________________________

Join the community of like-minded investors:

_____________________________________________________

Ask Prof Wolff: The Stock Market Is Rigged

BOMBSHELL PROOF that the Stock Market is RIGGED

The Stock Market is a Ponzi Scheme. Fully explained.

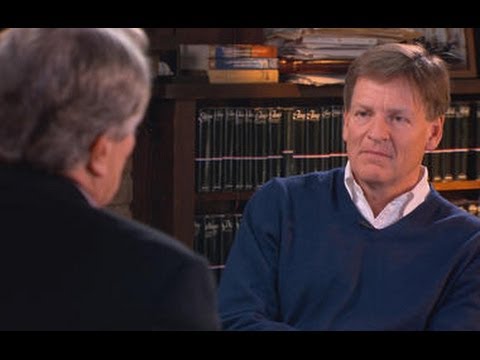

Stock Market Is Rigged, Explains Michael Lewis On '60 Minutes'

Buffett: The stock market isn't rigged

How Hedge Funds Manipulate The Stock Market

Stock Market is rigged

The stock market is REALLY rigged 🚨

Markets are Rigged. Using Charts and Technical Analysis alone is a road to the Poorhouse

Is the Stock Market Rigged? Peter Tuchman on How Retail Investors Can STILL Win

Proof the Stock Market is Rigged | VERY Scary.

The Stock Market Is RIGGED

Wall Street EXPOSED: How Markets are RIGGED

Proof that the Stock Market is RIGGED #trading #optionstrading

From the 60 Minutes Archive: Rigged

The Stock Market is Rigged! (And We Can Prove It!)

Yes, the stock market is rigged

The Stock Market is Rigged (But You Can Still Win)

The Stock Market is Rigged: Inside The World of Stock Market Manipulation

Proof the stock market is rigged

The Stock Market is Rigged Against You

Exposing the Scary Truth: Proof the Stock Market is Rigged

I Stopped Losing Money AFTER Understanding Market Manipulation

'The market is rigged': Day trader explains #yahoofinance

Комментарии

0:06:41

0:06:41

0:17:50

0:17:50

0:10:13

0:10:13

0:04:18

0:04:18

0:02:26

0:02:26

0:15:15

0:15:15

0:00:33

0:00:33

0:06:52

0:06:52

0:03:42

0:03:42

0:00:57

0:00:57

0:04:08

0:04:08

0:00:57

0:00:57

0:03:14

0:03:14

0:00:48

0:00:48

0:14:44

0:14:44

0:30:44

0:30:44

0:02:01

0:02:01

0:14:24

0:14:24

0:15:27

0:15:27

0:01:01

0:01:01

0:10:03

0:10:03

0:13:41

0:13:41

0:29:21

0:29:21

0:00:58

0:00:58