filmov

tv

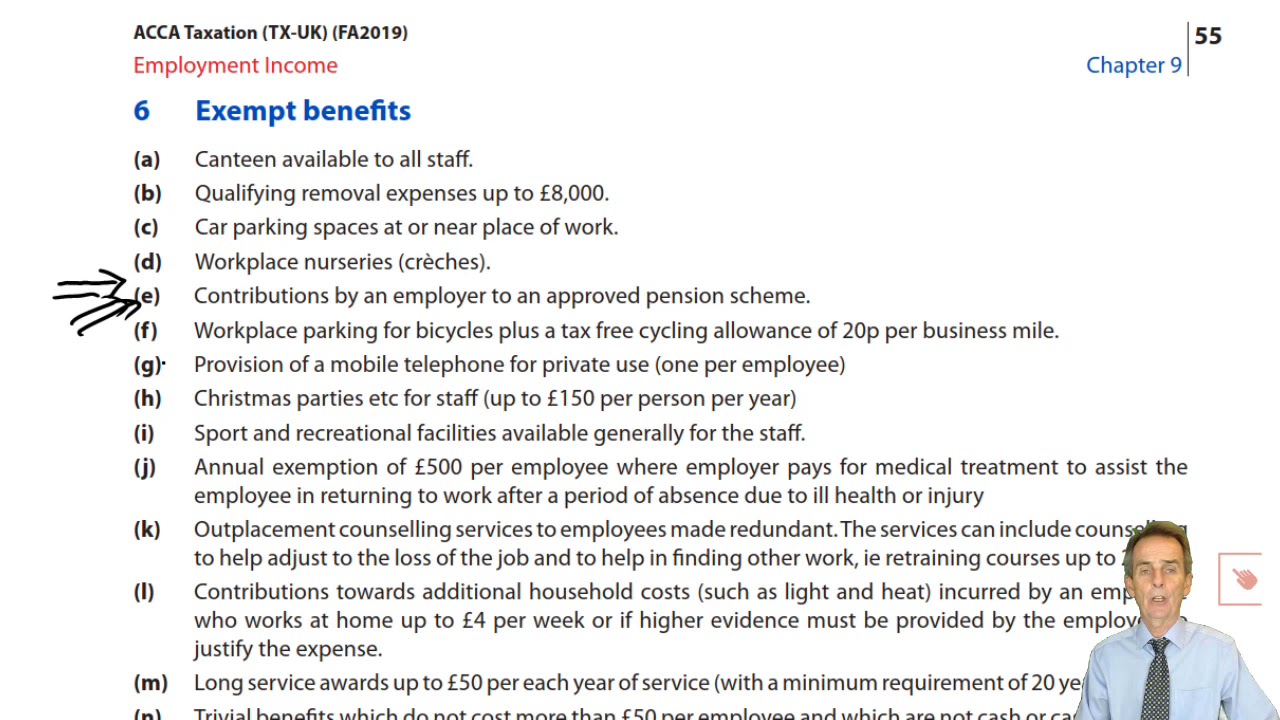

Introduction to Employment income - allowable expenses and exempt benefits – ACCA Taxation (TX-UK)

Показать описание

Introduction to Employment income - allowable expenses and exempt benefits – ACCA Taxation (TX-UK)

Please go to opentuition to post questions to our ACCA Tutor, we do not provide support on youtube comments section.

To benefit from our free lectures, visit OpenTuition to download the notes used in the lecture and access all ACCA free resources.

Access to all ACCA Taxation lectures, and Ask the ACCA Tutor Forums

Introduction to Employment Income - ACCA Taxation (TX-UK)

Introduction to employment income and allowable expenses - ACCA Taxation TX-UK lectures

Introduction to Employment income - allowable expenses and exempt benefits – ACCA Taxation (TX-UK)

Employment Income (part 1) - ACCA Taxation (FA 2022) TX-UK lectures

PFT - TAXATION OF EMPLOYMENT INCOME

Employment Income - Computational aspects

sec 4 PFT { TAXATION OF EMPLOYMENT INCOME }Class 1

EMPLOYMENT INCOME COMPUTATIONS

Spark Driver: How much I made on Saturday in 8 hours & is it worth it?

Taxation of Individual or Employment Income Question

Taxation Lectures || Employment Income Taxation (Part 1) || Taxation in Ghana

Taxation of Individual or Employment Income in Kenya

ACCA F6-Taxation (UK)- Chapter 5 - Employment Income (Part 1)

Employment Income Part 1

Taxation of Employment Income Webinar

ACCA I Taxation (TX-UK) I Employment Income - TX Lecture 5

Employment Income – Taxable Benefits: Motor Cars and fuel

Taxation of Employment Income CPA April 2022 Qn 3

Introduction to Income Tax in Uganda (Part I)

Employment Income (part 2) - ACCA Taxation (FA 2022) TX-UK lectures

ACCA I Advanced Taxation (ATX-UK) I Employment Income - ATX Lecture 2 I FA 2023

TAXATION ZIMBABWE : TAX FROM EMPLOYMENT & NON EMPLOYEMENT INCOME :- QPDs -FDS

IAS 12 - INCOME TAX (PART 1)

Taxation of Employment Income ATD III August 2021

Комментарии

0:06:34

0:06:34

0:59:55

0:59:55

0:48:34

0:48:34

0:17:24

0:17:24

1:52:00

1:52:00

0:56:06

0:56:06

1:39:20

1:39:20

1:58:02

1:58:02

0:11:13

0:11:13

0:15:14

0:15:14

0:31:04

0:31:04

0:06:19

0:06:19

0:42:26

0:42:26

1:06:19

1:06:19

1:50:58

1:50:58

4:35:07

4:35:07

0:30:26

0:30:26

0:42:23

0:42:23

0:31:28

0:31:28

0:21:02

0:21:02

4:19:27

4:19:27

2:37:46

2:37:46

0:29:38

0:29:38

0:25:35

0:25:35