filmov

tv

Option Volume & Open Interest | Options Trading For Beginners

Показать описание

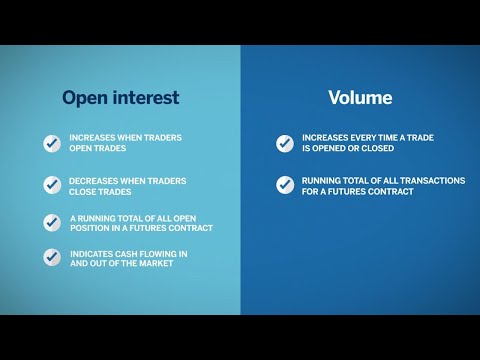

Option volume and open interest are two liquidity metrics all options traders should pay attention to before entering a trade.

Volume indicates the total number of option contracts that have traded on that day, while open interest represents the total number of open option contracts between two parties.

In this video, you'll learn about the basics of option volume and open interest, as well as which options tend to have the most volume and open interest, making it easier for you to enter and exit positions. tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Комментарии

0:12:42

0:12:42

0:12:50

0:12:50

0:08:02

0:08:02

0:06:27

0:06:27

0:07:30

0:07:30

0:09:59

0:09:59

0:10:12

0:10:12

0:02:46

0:02:46

1:04:47

1:04:47

0:11:36

0:11:36

0:13:39

0:13:39

0:05:53

0:05:53

0:08:52

0:08:52

0:10:21

0:10:21

0:03:25

0:03:25

0:03:57

0:03:57

0:07:27

0:07:27

0:08:12

0:08:12

0:07:04

0:07:04

0:19:57

0:19:57

0:05:35

0:05:35

0:14:27

0:14:27

0:14:24

0:14:24

0:10:44

0:10:44